A Brief Sojourn Through the History of Gold Trading

The history of gold trading is as old as the annals of human civilization itself. Gold, with its radiant sheen, has always been a symbol of wealth and influence in societies across the globe. The ancient Egyptians and Indians were known to have valued this precious metal in trade, and it played a critical role in shaping economies from antiquity to the Middle Ages.

Gold trading gained significant momentum in the 19th century with the establishment of gold standards by major economies worldwide. This system pegged their currencies to a specific amount of gold, thus creating an international basis for exchange rates.

However, after World War II, most countries abandoned this practice due to economic pressures. Nevertheless, gold continued to be traded globally as a valuable commodity.

The Relevance and Significance of Gold in Today’s Global Economy

In our modern world economy, gold maintains its illustrious status despite no longer being used as a standard for determining currency value. Despite this alteration in its role, gold remains enormously influential due mainly to its scarcity and enduring appeal as a store of wealth. Investors often resort to gold during economic crises as it often retains its value when other assets falter.

Moreover, central banks across nations hold substantial amounts of gold reserves that underpin their respective currencies’ value and instill confidence among other nations and investors alike. Additionally, sectors like jewelry manufacturing and technology (where it is used extensively in electronics) contribute significantly towards maintaining steady global demand for this lustrous metal.

An Overview: The Sine Qua Non Role Of A Gold Trading Company

A Gold Trading Company plays an integral role within this gilded economy; these companies form the crucial link between raw gold producers – typically miners – and consumers, which can range from individual investors to jewelry manufacturers. They are engaged in the buying, assaying (determining the purity), refining, and selling of gold. These companies not only provide liquidity to the gold market but also contribute towards price discovery by participating in domestic and international commodity exchanges.

Their rigorous quality control processes ensure that the gold circulating in the economy is of a certain minimum standard. Gold Trading Companies hence play a pivotal role in maintaining trust and confidence within this remarkably enduring market.

Understanding Gold Trading Companies

An In-Depth Look into the Definition and Purpose of a Gold Trading Company

A gold trading company can be succinctly defined as a business entity that specializes in buying, selling, and managing transactions related to gold and other precious metals. These companies play an instrumental role in maintaining the steady flow of these valuable resources within the global economy. They serve as a conduit between miners and end users, ensuring that gold is effectively sourced, processed, distributed and made accessible to various markets.

The purpose of a gold trading company is multifold. Such entities ensure liquidity in the market by providing a platform where buyers can easily purchase or sell gold.

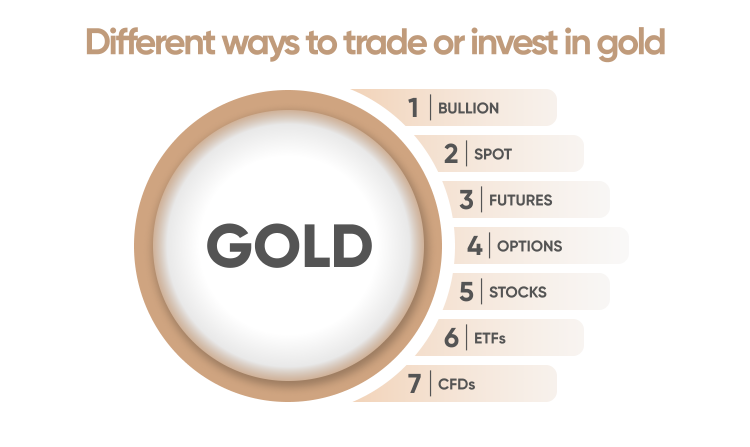

Additionally, they contribute to price discovery by facilitating transactions at amounts mutually agreed upon by buyers and sellers. Further, they help investors leverage the potential of this precious metal by offering services like online trading platforms where one can speculate on price movements or invest for long-term returns.

The Major Players: Key Industry Participants And Their Roles

The domain of gold trading operates within an intricate web woven by numerous stakeholders each playing significant roles. First are the mining companies who extract gold from earth’s crust; their endeavor forms the base for this industry’s existence.

Next are refiners who purify mined ore into high-quality bars or coins which are then ready for sale to traders. In liaison with regulators like London Bullion Market Association (LBMA), these companies ensure adherence to quality standards for globally traded bullion.

Gold traders themselves function at different scales – local bullion dealers focus on individual customers while large multinational companies cater to wholesale markets; some firms also specialize in derivative contracts allowing hedging against price volatility. Financial institutions shape investment trends through their commodity research & analysis while central banks influence prices via their monetary policies.

Peeling Back The Layers: The Structure Of A Typical Gold Trading Company

A typical gold trading company is a complex entity, organized in a manner to optimize its functioning in the multi-pronged precious metals industry. At the helm is the board of directors, followed by Executive Management which includes roles like the Chief Executive Officer (CEO), Chief Financial Officer (CFO), and heads of various departments such as Risk Management, Compliance, Operations, and Marketing. Drilling down further into the structure, we find teams dedicated to specific tasks – sourcing team liaises with miners or other suppliers for procurement; quality control ensures adherence to international purity standards; sales division works on strategies for reaching out to potential customers while customer service staff maintains robust client relationships.

Compliance officers ensure regulatory guidelines are followed at every step while risk managers monitor market conditions and devise measures to mitigate potential losses. In essence, a gold trading company is an intricate network of professionals working in unison towards achieving common business goals.

Operations of a Gold Trading Company

The Intricacies of Gold Sourcing: Mining, Recycling, and Individual Purchases

Gold Trading Companies canvas the globe in search for this precious commodity, embarking on a complex journey that begins deep within the heart of the earth. Mining is traditionally the primary source of gold supply, with companies investing in large-scale operations to extract it from gold-rich veins embedded in the substratum. These mining processes abide by strict standards and regulations to ensure both safety and environmental preservation.

From another perspective, gold recycling has become an increasingly prevalent method of sourcing. This involves refining old or discarded gold items to reclaim their intrinsic worth.

It not only contributes to a healthier ecosystem by reducing the need for mining but also taps into an extensive secondary reserve. Moreover, purchasing from individual sellers provides yet another avenue for sourcing gold – one that feeds on small-scale transactions but amounts to considerable quantities over time.

Quality Control Measures: Assaying and Hallmarking

The assurance of quality is non-negotiable in a Gold Trading Company’s operations. Rigorous quality control measures such as assaying and hallmarking are deployed as attestation techniques. Assaying is an analytical procedure aimed at determining purity – it involves meticulous testing using fire or X-ray fluorescence (XRF) methods to determine precise metal content.

Hallmarking serves as an official certification process conducted by authorized bodies that validate not only purity but also other critical quality parameters such as fineness and weight. The presence of these hallmarks on gold products infuses them with credibility, ensuring their acceptance across different markets worldwide.

Distribution Channels: Navigating Wholesale, Retail and Online Platforms

Upon securing its stockpile through rigorous sourcing protocols and quality control mechanisms, a Gold Trading Company’s next challenge lies in efficient distribution. Wholesale transactions form the backbone of this activity, allowing these companies to move large quantities of gold to other businesses such as jewelry manufacturers and financial institutions. Simultaneously, retail operations are instrumental in catering to individual customers, often through physical outlets strategically located in high-footfall areas.

In the contemporary digital age, Gold Trading Companies are also leveraging online platforms for distribution. This e-channel not only expands their reach but also provides them with a 24/7 operating window – a crucial advantage in the volatile world of gold trading.

A Global Outlook: Major Markets for Gold Trading

Asia, Europe, and the Americas stand as the titans in the realm of gold trading. Asia’s prominence is largely driven by China and India, the two largest consumers of gold worldwide. Their societal reverence for gold – seen in jewelry, religious ceremonies, and as a financial safeguard – creates an immense demand.

Meanwhile, Europe maintains its significant role due to its robust financial centers like London and Zurich, which are pivotal hubs for bullion trading. The Americas are not to be outdone.

The U.S., besides being a major consumer itself, hosts the New York Mercantile Exchange (NYMEX), one of the world’s largest commodities futures exchanges where gold contracts are traded heavily. Latin America contributes through its richly endowed gold mines that provide substantial supply to global markets.

Unveiling Potential: Emerging Markets in Gold Trading

While Africa has been historically associated with diamond trading, this continent is increasingly gaining recognition for gold trading too. Countries like South Africa and Ghana tout some of the world’s largest gold mines while artisanal miners across sub-Saharan Africa contribute significantly to production figures. Middle Eastern nations such as Saudi Arabia and the United Arab Emirates are also making their mark due to high consumption rates spurred by cultural practices and strategic investments into gold reserves.

The allure of these emerging markets lies not just in their burgeoning domestic consumption but also in their potential as new sources of supply. However, unlocking this potential necessitates dealing with challenges such as complex regulatory environments and infrastructural constraints.

Learning from Experience: Case Studies within the Gold Trading Industry

The story of Barrick Gold Corporation stands as the epitome of success in this industry. Starting with a single mine in 1983, it has grown astoundingly to become one of the world’s largest gold mining companies. Barrick’s success can be attributed to strategic acquisitions, efficient production methods, and a steady global demand for gold.

On the other hand, the collapse of Bre-X Minerals in 1997 serves as a cautionary tale. The Canadian company claimed to have struck an enormous gold deposit in Indonesia.

However, when it was revealed that samples had been tampered with and there was no significant deposit, share prices plummeted resulting in one of the biggest stock scandals in Canadian history. This case underscores the importance of transparency and ethical conduct within this lucrative but highly scrutinized industry.

The Economics of Gold Trading Companies: An In-depth Analysis

Pricing Mechanisms in the Gold Market

The pricing of gold is a complex process, contingent on a plethora of factors both macroeconomic and industry-specific. The most influencing factor perhaps lies within the purview of supply and demand dynamics. When demand exceeds supply, prices ascend, whereas in instances where supply overshadows demand, prices descend.

Furthermore, central banks across the globe hold vast reserves of gold. Their buying or selling activity can exert substantial influence on market prices.

Another pivotal element in determining the price of gold is market speculation. Gold futures contracts traded on commodities exchanges have a significant impact on immediate spot prices.

These future contracts are essentially agreements to buy or sell a certain amount of gold at a predetermined price at a specified future date. As speculators enter into these contracts based on their forecasted price trends, they can cause considerable oscillations in current market prices.

The Profitability Landscape: Margins and Revenue Streams

A Gold Trading Company’s profit margin is closely tethered to the variability in gold prices – buying low during periods of deflated market prices and selling high when markets rebound allows them to maintain profitable operations. They also generate revenue through commissions and fees charged for providing trading platforms to individual investors and institutional clients. In addition to profits from trade margins, these companies incorporate diversified business models to explore alternative revenue streams such as refining services for mined gold, fabricating bullion into customized products for retail customers, offering secure storage facilities for large-scale investors or even providing consultation services for newbie traders looking to invest in precious metals.

Global Economic Events: The Heartbeat Affecting Gold Demand & Prices

Gold has been historically regarded as a haven asset due to its intrinsic value which remains relatively stable over time. Therefore, during times of economic instability or uncertainty, investors tend to flock toward gold, driving up its demand and consequently its price. For instance, the Global Financial Crisis of 2008 and more recently, the economic fallout from the COVID-19 pandemic led to a surge in gold prices as investors sought refuge from volatile equity markets.

Conversely, when global economies are in a state of expansion and other investment avenues such as stocks yield higher returns, gold might fall out of favor leading to diminished demand and lower prices. Additionally, changes in monetary policy by central banks – like adjustments in interest rates or quantitative easing measures – can cause significant swings in gold prices due to their direct impact on currency values and inflation rates.

Risks & Challenges Facing Gold Trading Companies

The Perils of Political Instability in Mining Regions

Political instability primarily emanates from the countries where the gold is sourced. Tumultuous geopolitical landscapes often littered with chronic civil unrest, armed conflicts, and erratic governance can significantly disrupt gold mining operations. These regions may impose onerous and unpredictable regulations, exorbitant taxes, or may even nationalize resources without substantial compensation to foreign investors.

This kind of volatility poses a significant risk for Gold Trading Companies that source their products from such regions. Furthermore, trade sanctions imposed upon politically unstable nations by international powers also pose challenges.

For instance, if a western country imposes economic sanctions against a mining region due to human rights violations or other political reasons, it could severely restrict the activities of international gold trading companies operating in those areas. In essence, political instability in mining regions introduces an element of unpredictability that can drastically impact the supply chain logistics and overall profitability.

Navigating Through Financial Risks Such as Market Volatility

The financial health of Gold Trading Companies is inexorably tied to market volatility – specifically fluctuations in gold prices that are influenced by macroeconomic indicators and investor sentiment. Investors often turn to gold during times of economic uncertainty, which drives up prices; conversely, during periods of economic stability and growth, demand for gold may dwindle leading to lower prices.

In addition to price volatility challenges associated with global market dynamics there exist currency exchange risks due given most commodities are traded in US dollars globally. A sudden surge or slump in Dollar value compared to other currencies impacts the buying power of Gold Trading Companies negatively impacting profits further adding complexity to financial management within these entities.

Environmental Concerns Over Mining Practices: An Emerging Hurdle

Environmental issues related to gold mining have long been a contested issue. Traditional gold mining processes can lead to deforestation, soil degradation, and water contamination due to the use of harmful chemicals such as cyanide and mercury. These practices cause irreparable harm to local ecosystems and biodiversity.

As public consciousness about environmental sustainability grows, Gold Trading Companies face increasing pressure from regulators, investors, and the general public to ensure their gold is sourced responsibly. The cost associated with adopting sustainable mining practices or sourcing from environmentally responsible mines can be considerable.

Additionally, companies may face legal action or reputational damage if they fail to meet environmental standards or are implicated in environmentally harmful activities. In an era where consumers are more aware and demanding about corporate social responsibility (CSR), these environmental concerns pose significant challenges for Gold Trading Companies globally.

Technology: The Golden Thread in Trading

Blockchain: A Golden Standard for Transparency

Blockchain technology, commonly associated with cryptocurrencies such as Bitcoin, has made a notable impact on Gold Trading Companies. It presents a promising solution to one of the industry’s enduring challenges – tracking provenance.

Each block in a blockchain network records an array of data which, in this case, can include the origin and transaction history of gold, bringing an unprecedented level of transparency to the process. In practical terms, blockchain enables consumers to trace each piece of gold back to its mine of origin.

This assurance confirms they are not inadvertently supporting unethical mining practices. For companies, it offers a tangible method for enforcing and validating responsible sourcing initiatives which bolsters their credibility and brand equity in the market.

Leveraging AI & Machine Learning: Predicting Glittering Opportunities

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing how Gold Trading Companies forecast market trends. These advanced technologies enable companies to analyze massive volumes of data related to gold trading from multiple sources in real time. This analysis includes factors such as global economic indicators, political events, currency fluctuations and even social media sentiment.

By processing this information through sophisticated algorithms, AI and ML can predict future price trends with higher accuracy than traditional methods. This advanced predictive capability allows businesses to make more informed decisions about when to buy or sell gold — maximizing their profits while reducing the risk that is inherent in such trades.

E-Commerce Platforms: The New Marketplaces for Shimmering Transactions

With an increasing number of digital natives becoming financially literate and interested in investment options beyond equities or bonds, e-commerce platforms have emerged as facilitators for online gold trading. They offer user-friendly interfaces that simplify buying procedures making them accessible even for those with minimal technical or financial know-how. Moreover, these platforms provide a high level of convenience and flexibility.

They allow investors to trade at any time, from any location, eliminating the constraints of traditional market hours or geographical boundaries. This paradigm shift has opened up gold trading to a whole new demographic and geographic segment — contributing significantly to the growth and globalization of the industry.

Ethical Considerations & Social Responsibility in the Industry

The Imperative of Fair Trade Practices

Fair trade practices have increasingly become an indispensable element in the operation of Gold Trading Companies. These practices are enshrined in ethical standards that regulate the gold industry, seeking to create a sustainable and just supply chain. This involves ensuring all stakeholders, from miners to sellers, receive equitable pay and work under favorable conditions.

Gold companies implementing these practices demonstrate an appreciation for humanity and the dignity of labor, transcending the quest for exorbitant profits. Proper adherence to fair trade norms not only boosts a company’s reputation but also fosters trust amongst clients and partners.

Commitment to Responsible Sourcing Initiatives

In addition to fair trade practices, responsible sourcing initiatives have gained prominence in this industry. These initiatives dictate that companies should be mindful of where they source their gold – ensuring it doesn’t stem from conflict zones or places notorious for child labor or poor working conditions.

It involves conducting rigorous due diligence before engaging with suppliers, and becoming aware of their mining practices, labor policies and environmental impact. Such a commitment underscores a company’s dedication towards maintaining ethical standards across its supply chain while contributing positively towards global peace efforts.

Community Engagement Activities

Sowing Seeds of Mutual Growth

Gold Trading Companies are increasingly realising that their success is closely intertwined with the welfare of communities where they operate or source from. Therefore, many engage in community projects aimed at improving living standards – whether through education initiatives, healthcare facilities or infrastructural development programs. These activities help foster goodwill between companies and communities while acting as corporate social responsibility.

Nurturing Sustainable Relationships Through Engagement

Beyond one-off donations or projects, continuous engagement forms a crucial part of community activities for these enterprises. Gold trading firms often establish local offices, hire local talent, and actively engage with community leaders to understand their needs better. This approach ensures that the company’s operations align with the interests of locals, thus fostering a more sustainable and symbiotic relationship.

Conclusion

In the world of gold trading, the glitter is not merely about profit margins. It extends to encompass ethical considerations and social responsibility. Fair trade practices, responsible sourcing initiatives, and community engagement are no longer seen as optional extras but as integral threads in the golden tapestry of this industry.

While challenges remain in enforcing these standards globally, the journey towards a more equitable gold industry is well underway – a testament to human ingenuity and our collective commitment to fairness and sustainability. Herein lies an optimistic promise for all stakeholders in this illustrious realm – a future where prosperity leaves no one behind.