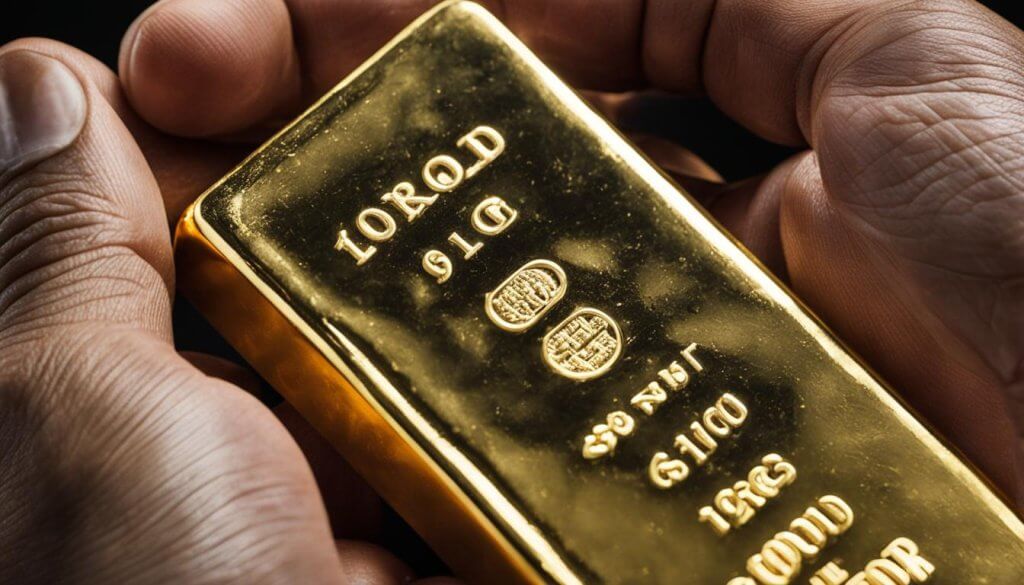

There is something undeniably unique and luxurious about holding a 1kg gold bar in your hand. It’s a tangible investment that can be admired, appreciated, and preserved over time. For those seeking a secure and attractive investment option, purchasing a gold bar may hold significant appeal.

Gold has long been regarded as a symbol of wealth and status, and despite fluctuations in the market, it remains a popular choice for investors seeking to diversify their portfolios. Owning a 1kg gold bar in hand not only offers the potential for long-term returns, but it also provides a level of emotional satisfaction that other investment assets simply cannot match.

Key Takeaways:

- A 1kg gold bar is a tangible investment that can be physically held and admired.

- Gold has long been a symbol of wealth and is a popular choice for diversifying investment portfolios.

- Owning a 1kg gold bar can provide emotional satisfaction in addition to long-term investment potential.

- Gold bars can be purchased from reliable dealers, and secure storage is crucial for protecting your investment.

- Investing in tangible assets like gold can act as a hedge against economic uncertainty and provide long-term wealth preservation.

Buying a 1kg Gold Bar

Buying a 1kg gold bar is an excellent investment choice for those seeking tangible assets. You can purchase your gold bar through different avenues, including banks, gold dealers, and online retailers. It’s essential to do your research and verify the reliability of your chosen dealer before making your purchase.

Looking for reputable gold bar dealers? Check out some of the industry’s top names, such as Scotiabank, American Precious Metals Exchange, and JM Bullion.

| Options | Pros | Cons |

|---|---|---|

| Banks | Secure, convenient | Limited selection, high premiums |

| Gold Dealers | Wide selection, competitive prices | May require shipping and insurance costs |

| Online Retailers | Convenient, accessible 24/7 | May have hidden fees, unreliable dealers |

When buying a 1kg gold bar, always verify the dealer’s reputation and security measures to ensure a safe and reputable transaction.

Things to Consider when Buying a 1kg Gold Bar:

- Spot prices and premiums

- Dealer reputation and reliability

- Shipping and insurance costs

- Storage options

By following these tips and guidelines, you can make a secure and informed purchase of a 1kg gold bar.

Securing Your Investment

Protecting your 1kg gold bar and storing it safely is vital to ensure its long-term value. Here are some essential tips for secure storage:

- Choose a secure storage option: Consider a safety deposit box at a bank or a specialized storage facility. Home safes are an option, but they may not be as secure as a professional storage solution.

- Take out insurance: Make sure your 1kg gold bar is fully insured to protect your investment from loss or damage.

- Don’t disclose your storage location: Keep the location of your gold bar discreet and known only to trusted parties.

- Avoid leaving your gold bar in plain sight: Keep your gold bar away from windows and other areas that are visible from the outside of your home or storage location.

- Regularly check on your gold bar: Conduct periodic inspections of your gold bar to ensure it remains in good condition and has not been tampered with.

Following these secure storage tips can give you peace of mind and ensure the long-term protection of your valuable asset.

Benefits of Tangible Gold Investment

Investing in tangible assets like a 1kg gold bar has significant advantages. Gold investment can help diversify your portfolio, offering a reliable hedge against economic uncertainty. Unlike paper currency or stocks, gold is a tangible asset that can provide long-term wealth preservation.

By diversifying your portfolio with tangible assets such as gold, you can protect your investments from market volatility. The stability of gold investment can help balance your stocks and bonds, and its value often increases during market downturns.

Gold can also offer a unique emotional satisfaction and sense of security. Holding physical gold in your hand and knowing it is a secure investment can provide peace of mind.

“Gold is a valuable asset to have in your investment portfolio. It’s an excellent hedge against inflation and often rises in value when the stock market falls. Gold is the ultimate tangible asset that can never lose its worth.” – Warren Buffet

The Value of Holding Gold in Hand

When it comes to investing in physical gold, there is a unique value that comes with holding a 1kg gold bar in your hand. Physical gold is a tangible asset that provides a sense of security and connection to your investment.

The cultural and historical significance of gold only adds to its universal appeal. For thousands of years, gold has been revered as a symbol of wealth and power, making it a sought-after commodity all over the world.

Investing in physical gold offers a sense of tangible connection to your investment, something that cannot be replicated with paper assets. Holding a gold bar in your hand can give you emotional satisfaction and a feeling of security, knowing that you have a valuable asset within your grasp.

“Gold is not a metal that loses its value. It has been considered a precious commodity for centuries, and it will always be in demand.”

One of the primary benefits of holding physical gold is that it is a hedge against economic uncertainty. While paper assets are subject to inflation and market volatility, gold has historically maintained its value over time, making it an attractive choice for those looking to diversify their investment portfolio.

Conclusion

Owning a 1kg gold bar can be a prestigious and alluring investment choice for those seeking tangible assets. It is important to buy from a reputable gold bar dealer and properly store your investment to protect it from theft or damage.

Investing in tangible assets like gold can provide a hedge against economic uncertainty, diversify your investment portfolio, and preserve long-term wealth. However, it is crucial to consider the risks, costs, and benefits before making any investment decisions.

Physically holding a 1kg gold bar can offer a unique emotional satisfaction and connection to history and culture. It is a tangible asset that can provide a sense of security and stability in uncertain times.

Overall, owning a 1kg gold bar in hand can offer a range of benefits and considerations that should be carefully weighed before making any investment decisions. It is important to do your research, understand the risks involved, and make an informed decision based on your financial goals and needs.

FAQ

Can I buy a 1kg gold bar in person?

Yes, you can purchase a 1kg gold bar in person from authorized gold dealers and precious metal retailers. It is important to ensure the dealer is reputable and offers authentic gold bars.

How much does a 1kg gold bar cost?

The cost of a 1kg gold bar fluctuates based on the current market price of gold. It is recommended to check with multiple dealers to compare prices and ensure you are getting a competitive rate.

How do I store a 1kg gold bar securely?

To securely store a 1kg gold bar, consider options such as a secure home safe, a safety deposit box at a bank, or a specialized storage facility. It is important to choose a storage method that offers protection from theft and damage.

Can I insure my 1kg gold bar?

Yes, it is possible to purchase insurance coverage for your 1kg gold bar. Contact reputable insurance providers to inquire about policies specifically designed for precious metals and ensure your investment is adequately protected.

Why should I invest in tangible assets like a 1kg gold bar?

Tangible assets like a 1kg gold bar can provide stability and diversification to an investment portfolio. Gold has historically served as a hedge against economic uncertainty and can help preserve wealth over the long term.

What is the cultural significance of holding a 1kg gold bar?

Holding a 1kg gold bar carries both historical and cultural significance. Gold has been revered across civilizations for its beauty, durability, and as a symbol of wealth. Owning a gold bar allows you to connect with this rich heritage and appreciate its universal appeal.

Is owning a 1kg gold bar a wise investment?

Owning a 1kg gold bar can be a wise investment for those seeking a tangible asset with long-term value. However, it is essential to carefully consider your financial goals, risk tolerance, and consult with a financial advisor before making any investment decisions.