Gold Market

Gold, a lustrous and malleable precious metal, has captivated humans for centuries with its timeless beauty and intrinsic value. Its significance as a store of wealth and a medium of exchange dates back to ancient civilizations, where it played a central role in trade and economic systems. Today, gold continues to hold immense importance in the global financial landscape.

Definition and Significance of Gold as a Precious Metal

Gold is classified as a precious metal due to its rarity, aesthetic appeal, and high economic value. Its unique properties make it highly sought after for various purposes, including jewellery production, industrial applications such as electronics and dentistry, and, most notably, as an investment asset. Gold’s scarcity ensures that its value remains relatively stable over time compared to other commodities.

The enduring allure of gold stems from its timeless appeal across different cultures. Throughout history, gold has been associated with power, wealth, luxury, and prestige.

Gold adorned the tombs of pharaohs in ancient Egypt and the crowns of royalty worldwide. Its cultural significance elevates gold beyond mere monetary value into something symbolic.

Historical Background and Cultural Significance of Gold

Gold’s rich historical background spans millennia. From Egyptian civilization’s use of gold in religious rituals to the Inca empire’s intricate golden artefacts signifying their divine rulership, societies have revered this precious metal for its inherent beauty and symbolism. The discovery of vast amounts of gold during major historical events, such as the California Gold Rush in 1848 or South Africa’s Witwatersrand Gold Rush at the end of the 19th century, fueled frenzies that shaped economies and societies alike.

Culturally diverse traditions also associate gold with auspicious occasions like weddings or religious ceremonies, symbolising purity or divinity. Moreover, gold has been synonymous with prosperity and economic stability, leading to its adoption as a standard of monetary exchange in many civilizations.

Overview of the Global Gold Market

The global gold market encompasses various entities engaged in gold production, trade, and investment. Mining companies extract gold from the earth’s crust, refining it into pure metal before it enters the larger market.

Diverse stakeholders drive the demand for gold: individuals seeking to invest or own physical gold, jewellery manufacturers utilizing its aesthetic appeal, industrial sectors requiring unique properties, and central banks managing their reserves. Gold’s value is determined by supply and demand dynamics influenced by macroeconomic factors such as interest rates, inflation pressures, geopolitical tensions, and currency fluctuations.

The price discovery mechanism occurs primarily through global exchanges, where bullion banks trade physical gold or derivative financial instruments tied to its value. This market’s international nature allows for continuous trading around the clock across different time zones.

Significant hubs include London’s over-the-counter market (OTC), New York’s COMEX exchange, which offers futures contracts on gold prices, and Shanghai’s Gold Exchange, which caters to Asian demand. Understanding these intricacies is essential for investors seeking exposure to the dynamic world of gold trading.

Understanding the definitions and significance of gold as a precious metal sets the stage for comprehending its historical background and cultural relevance worldwide. Furthermore, an overview of the global gold market provides a solid foundation for exploring its investment potential and understanding its role amidst evolving economic circumstances.

Understanding Gold as an Investment

Reasons why investors choose to invest in gold

Gold has long been revered as a valuable asset because it can hedge against inflation and economic uncertainties. During economic downturns or high inflation rates, gold often retains its value, providing investors with a haven for their wealth. This is because the supply of gold is limited, unlike fiat currencies, which can be printed at will by central banks.

Additionally, gold has a long-term track record of maintaining its purchasing power. Furthermore, it protects against geopolitical tensions and international crises, making it highly sought after during periods of global uncertainty.

Diversification benefits for investment portfolios

Investing in gold offers diversification benefits that can help mitigate risk in investment portfolios. Unlike traditional financial assets such as stocks and bonds, which are subject to market fluctuations and influenced by economic conditions, the price of gold often moves independently from other asset classes.

This means that when stocks or bonds decline in value during market downturns, the price of gold may rise or remain stable. Investors can reduce their overall portfolio volatility by including gold in an investment portfolio and potentially improve risk-adjusted returns.

Store of value and long-term wealth preservation

One primary reason investors allocate capital to gold is its ability to preserve wealth over the long term. Civilizations have recognized the enduring value of this precious metal throughout history.

Gold possesses intrinsic qualities such as scarcity and durability, enabling it to maintain its purchasing power across generations. Whether stored physically or through financial instruments, gold has proven reliable in preserving wealth over extended periods.

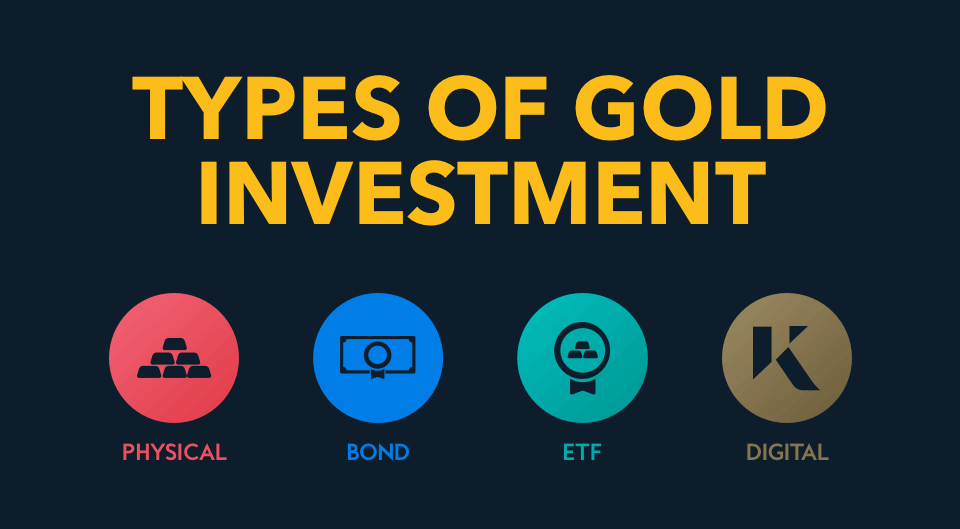

Different forms of Gold Investments

Physical gold: bullion, coins, and bars

Investors have various options when investing in physical gold, including bullion, coins, and bars. Bullion refers to gold bars or ingots, typically made of high-purity gold and in various sizes.

Investors can opt for cast bullion, usually produced by pouring molten gold into moulds, or minted bullion, which undergoes a more refined manufacturing process and produces precisely shaped bars or coins. While bullion’s purity levels can vary, the most common is 99.99% pure (24 karats).

Additionally, many investors are drawn to popular gold coins like the American Eagle or Canadian Maple Leaf due to their recognized purity and authenticity. Moreover, some collectors seek out rare numismatic coins for their historical value and rarity.

Gold ETFs (Exchange-Traded Funds)

Gold ETFs have gained significant popularity as an investment vehicle due to their convenience and liquidity features. These funds typically track the price of gold by holding physical gold or derivatives contracts with underlying assets tied to the metal’s value.

Investing in a gold ETF allows investors to gain exposure to gold’s price movements without physically owning it. This eliminates concerns about storage or security associated with physical ownership.

Gold mining stocks and mutual funds

Investors interested in gaining exposure to the potential returns generated by companies involved in gold mining may consider investing in individual mining stocks or mutual funds focused on this sector. This approach lets investors indirectly own physical gold through shares in companies engaged in extraction and exploration activities.

While investing in mining companies offers the potential for higher returns than holding physical gold alone, it also introduces additional risks, such as operational challenges, environmental concerns, regulatory issues, and company-specific performance factors, that need careful consideration. By understanding these various investment avenues within precious metals like gold, investors can make informed decisions based on their financial goals and risk tolerance levels.

Factors Influencing the Gold Market

Macroeconomic factors affecting gold prices

Gold prices are heavily influenced by various macroeconomic factors, which can impact the market’s supply and demand dynamics. One such factor is interest rates and monetary policy decisions. Low interest rates often lead investors to seek alternative investments like gold, which is seen as a store of value.

Additionally, changes in monetary policy decisions by central banks can significantly impact gold prices. For example, if a central bank implements quantitative easing measures or expands its money supply, it can create inflationary concerns and weaken the currency, thereby increasing the attractiveness of gold as a safe-haven asset.

Inflationary pressures and currency fluctuations also play crucial roles in determining gold prices. As inflation rises, the purchasing power of fiat currencies decreases, leading investors to flock to gold as an inflation hedge.

Moreover, currency fluctuations can affect international demand for gold since it is priced in US dollars. If there are uncertainties surrounding major currencies or geopolitical tensions impacting exchange rates, it could drive up global demand for gold.

Microeconomic factors impacting supply and demand dynamics

The gold market’s microeconomic factors primarily revolve around production trends and consumption patterns. Gold production trends worldwide play a pivotal role in determining supply levels in the market. Due to their extensive mining operations, major producing countries like China, Australia, Russia, and others significantly impact global supply levels.

However, environmental concerns related to mining operations have become increasingly important in recent years. The environmental impact of large-scale mining activities has raised awareness about sustainable practices and responsible sourcing within the industry.

On the other side of the equation lies gold consumption patterns across sectors. Gold is widely used across various industries, such as jewellery manufacturing, electronics production (including smartphones), dentistry applications, investment purposes (coins/bars), and central bank reserves.

The demand for gold within each sector can fluctuate based on economic conditions, consumer preferences, and technological advancements. Understanding these consumption patterns is crucial in assessing the overall demand for gold and its potential impact on prices.

Conclusion

Many factors influence the gold market at both macroeconomic and microeconomic levels. Macroeconomic factors such as interest rates, inflationary pressures, currency fluctuations, and geopolitical tensions shape investor sentiment toward gold.

Meanwhile, microeconomic factors like production trends in major producing countries and gold consumption patterns across sectors dictate supply and demand dynamics. By comprehending the interplay between these various factors, investors can more effectively navigate the intricacies of the gold market.

Despite its volatility, gold has proven to be a reliable asset in times of uncertainty or financial turmoil. Its enduring allure lies in its ability to retain value over time, making it an attractive option for long-term wealth preservation strategies.