Palladium Investment, a lustrous silvery-white metal, resides as a platinum group metals (PGMs) member within the periodic table’s auspices. Discovered in 1803 by William Hyde Wollaston, this rare and precious element has established its irreplaceability over time.

Highly resistant to wear and tarnish, palladium is aesthetically pleasing and incredibly durable—qualities that make it a jeweller’s delight. Beyond its gleaming exterior, palladium also possesses unique chemical properties.

It absorbs vast amounts of hydrogen at room temperature, making it valuable for industries. Its rarity surpasses even that of gold and platinum, underscoring its high value – a point further accentuated by the fact that palladium deposits are primarily found in only two countries worldwide: South Africa and Russia.

Palladium’s Pervasive Presence: An Industrial Marvel

The importance of palladium extends far beyond its ornamental appeal; the metal has made significant strides in various industrial applications due to its specific characteristics. The automotive industry heavily depends on palladium for catalytic converters that help reduce harmful gas emissions from vehicles.

Given stringent global environmental regulations and a growing emphasis on curbing pollution levels, demand for these converters—and hence palladium—has been soaring. In addition to this essential role in vehicular emission control systems, Palladium is utilized within electronics manufacturing due to its excellent conductivity properties.

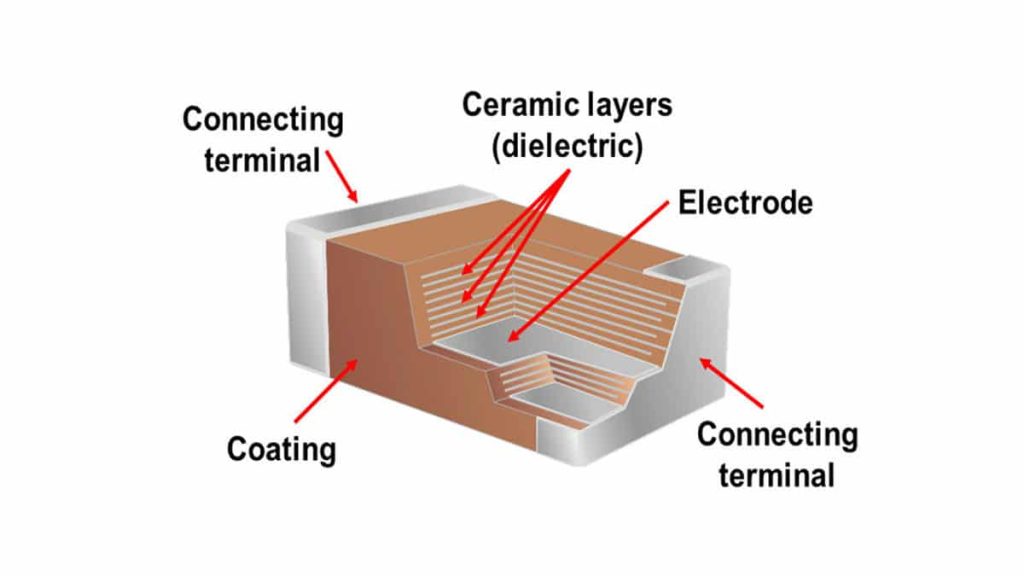

It is within multi-layer ceramic capacitors (MLCCs), which are heavily used in mobile communication devices and computer products. Furthermore, prowess in facilitating specific chemical reactions makes Palladium desirable in dentistry and medicine.

Emergence of Palladian Investment: A Precious Opportunity

Given the increasing demand and limited supply, Palladium has experienced a noticeable surge as an investment option. Investors have been keen to tap into its potential as a valuable addition to their portfolios, particularly in recent years.

The price of palladium has grown impressively, outperforming its PGM peers and even surpassing the traditionally dominant gold at times. The rise in palladium prices is not just a product of its industrial utility but also reflects geopolitical uncertainties affecting its supply.

Potential disruptions in mining operations in Russia or South Africa—the two most significant producers—can cause acute shortages and price spikes. Thus, investing in palladium can be a bet on continued industrial demand and a hedge against geopolitical risks.

Understanding the Basics of Palladium Investment

Unveiling the Enigma: What is Palladium Investment?

Palladium investment, put, refers to allocating funds to acquire palladium, a precious metal, in anticipation of capital appreciation. This investment can be manifested in either physical form or imbued within financial instruments.

Physical palladium investment involves purchasing tangible palladium assets such as bars or coins. The allure of this investment is having direct ownership over a palpable asset whose value is intrinsically tied to global market forces.

Investors accumulate these tangible products to hedge against inflation and currency depreciation and protect against economic turmoil. Conversely, paper palladium investment involves indirect ownership through financial securities like stocks and exchange-traded funds (ETFs).

These instruments are backed by physical palladium reserves, offering fluidity that rivals traditional equity markets. Investors often favour this approach due to its convenience and reduced need for storage and insurance compared to physical assets.

The Odyssey of Palladium: History & Evolution

Since its inception in the late 20th century, the journey of palladium investments has been intriguingly variegated. The defining moment arrived when Russia withheld supplies from 2000 to 2001, leading to skyrocketing prices. This event highlighted both its rarity and fragile supply chain.

In recent years, demand for this silvery-white metal has exploded, primarily due to its use in catalytic converters for petrol-fueled vehicles. Coupled with production deficits at significant mines in South Africa and Russia—two primary producers—prices have reached historical peaks, making it an attractive option for investors worldwide.

The evolution of paper investments like ETFs and stocks tied to palladium has further democratized access, allowing everyone from significant hedge funds to individual investors to participate. This has given birth to an intricate global market that operates around the clock.

Looking Through the Prism: Major Historical Events & Recent Developments

Investing in palladium has had its fair share of vicissitudes, attributable primarily to geopolitical factors and supply-demand dynamics. The aforementioned Russian supply crisis of the early 2000s is one such example that underscores how geopolitical factors can significantly sway market prices. More recently, escalating trade tensions and shifts in automobile industry regulations have influenced the palladium market.

China’s tightening emission norms have increased the use of palladium in car manufacturing, fueling demand despite constrained supplies. Moreover, technological advancements like blockchain facilitate new avenues for investing in tokenized assets.

This creates an opportunity for fractional ownership, further lowering the entry barrier while ensuring transparency and security. Consequently, we are witnessing a paradigm shift toward digitization that could reshape the landscape of palladium investments.

Why Invest in Palladium?

Factors Driving the Demand for Palladium

Palladium, a lustrous silver-white metal, is gaining prominence due to its increasing industrial utility. Its most notable application is in the automobile industry, where it is a vital component in catalytic converters.

These devices help reduce harmful emissions, and with growing environmental consciousness and tighter emission regulations globally, the demand for palladium is expected to surge. However, its utilitarian function is not the only reason palladium is an attractive investment.

The supply of this precious metal is limited; it’s primarily extracted as a byproduct from nickel and platinum mining. This supply constraint, coupled with rising demand, invariably leads to an appreciation in price over time, making it an attractive prospect for long-term investors.

Diversification Benefits and Comparative Performance

A well-diversified investment portfolio is generally considered less risky. Palladium could serve as a hedge against inflation or market volatility. Historically, it has shown an inverse correlation with traditional financial instruments like stocks during economic downturns.

Compared to other precious metals like gold or silver, pallidum has had moments of outperformance mainly driven by industry-specific demands rather than the more sentiment-driven movements of gold and silver. This unique price behaviour adds another layer of diversification benefits.

How to Invest in Palladium?

Physical Investment: Bars, Coins and Ingots

Physical possession of palladium provides investors with a tangible asset that holds intrinsic value. Bullion dealers or mints worldwide can procure bars, coins, or ingots. However, investing physically carries certain disadvantages, such as storage costs, security concerns, and liquidity issues when selling one’s holdings.

It’s crucial for investors considering this path to consider storage and insurance options. Safe deposit boxes in banks, home safes or professional bullion storage facilities are common choices, each with its own cost implications and level of security.

Paper Investment: ETFs, Stocks and Futures Contracts

Paper investments provide an alternative path for those looking for a more liquid investment without the hassles of physical possession. These include palladium exchange traded funds (ETFs), mining company stocks, and commodity exchange futures contracts. However, these paper investments come with their own set of risks.

ETFs, for instance, are susceptible to ‘tracking errors, ‘ while stocks expose investors to company-specific risks. Understanding the mechanics and intricacies of such investment vehicles is paramount before exploring this avenue.

Risks Involved with Investing in Palladium

Market Volatility and Geopolitical Risks

Like any commodity market, palladium prices can be volatile due to supply-demand dynamics. A slowdown in industries using palladium could lead to a slump in prices, while a surge could inflate them overnight.

Geopolitical risks pose another significant concern as most of the world’s palladium supply comes from politically unstable regions like Russia and South Africa. Any disturbance or changes in regulatory policies could disrupt the global supply chain.

Palladium Investment: Regulatory Risks

Environmental concerns over mining operations have led many nations to enforce stringent regulations on mining companies. Such interventions can impact production capabilities, affecting palladium’s price and availability.

Case Studies on Successful Palladium Investments

While it’s always provided a handsome return, correctly estimating market shifts has yielded significant returns in certain historical moments. Understanding these instances can offer prospective investors valuable lessons about factors that drive price movements, helping them make informed decisions about their investment strategies.

Future Outlook for Palladium Investments

The future of palladium investments seems promising. With the increasing global demand for cleaner energy and stricter emission norms, the demand for palladium is expected to rise. While challenges remain, the potential rewards make it an investment avenue worth considering.

Conclusion

Palladium investments have their rewards and risks. Understanding these intricacies will enable investors to navigate this market effectively and potentially reap significant returns.

The journey may be fraught with risks, but as with any investment, informed decision-making is the key to success. As we move towards a future dominated by clean energy, palladium is poised to shine brighter than ever, presenting a golden opportunity for savvy investors.