In today’s uncertain economy, many turn to tangible assets for safety and security. Gold bars are a top pick for investors seeking stability. This guide explores the benefits of investing in gold, the key differences between bars and coins, how they’re made, and what affects their value. You’ll also learn the best ways to buy, store, and protect your gold investments. By the end, you’ll have the insight needed to wisely include gold bars in your portfolio.

For gold to be investment grade, it must be at least 99.5% pure.1 This makes it prized by banks, governments, and individuals.1 The most widespread type of gold bar is the 400 oz London Good Delivery bar.1 Buying these gold bars can strengthen your finances during economic downturns. They often increase in value when markets are shaky.1

It’s important to buy from reputable sources like the Royal Canadian Mint, Valcambi, and PAMP Suisse. They have strict standards to ensure the gold’s authenticity.1 Several factors, including gold content and demand, affect a gold bar’s worth. The gold spot price, which reflects the wholesale value of 400 oz bars, is also key.1

Whether you’re new to gold investing or a seasoned pro, this guide is for you. It will help you make smart choices that match your investment strategy and risk level. The insights and advice offered here are designed to maximize the potential of your gold investments.

Understanding the Allure of Physical Gold

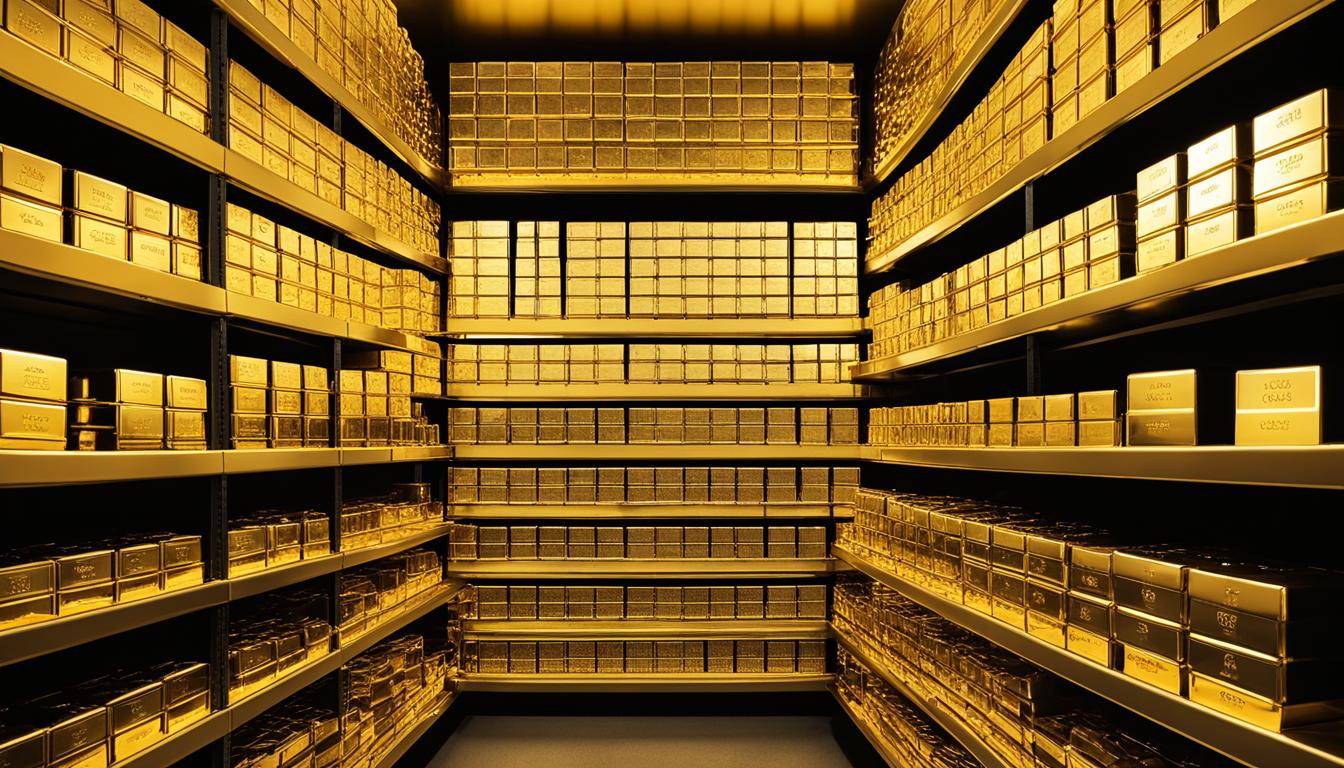

Physical gold has always been precious for many reasons. It’s real, you can take it anywhere, and it’s tough against tough times. Gold bars especially let investors directly own the metal, giving a feeling of safety and power over their money. They differ from paper gold like ETFs. This is because you can keep gold bars safe or reach them easily.2

The Appeal of Tangible Assets

The real nature of gold bars is key to why they’re so popular.2 People who like holding what they own value having real gold. It helps protect against price rises and keeps its value when things are shaky.2

Gold as a Safe-Haven Investment

Gold is known for staying valuable despite the ups and downs of money and the world.2 Those looking to make their investments safer often choose gold. It gives them a feeling of safety and steadiness.2

The Historical Significance of Gold

Gold’s importance through time also makes it attractive.2 For ages, people have traded with gold and used it to keep their wealth. Its value and rarity have made it desired across many cultures.2 Knowing this makes owning gold more special for some investors.2

Exploring the Differences: Gold Bars vs. Gold Coins

Investors often need to choose between gold bars or gold coins for their physical gold investments. Both types are high-quality, with a minimum purity of 99.5%. Yet, they have different features and appealing points.

Gold Bars: The Epitome of Pure Investment

Gold bars are seen as a pure form of investment. They are simple and cost-effective to buy.3 Because they don’t have much design or historical value, they’re great for those wanting to keep their wealth steady.4

4 Large investments might find gold bars more budget-friendly. This is because they usually cost less.4 Gold bars are made with 99.5% or more purity, making them reliable investments.

Gold Coins: Collectible Treasures with Artistic Value

Gold coins, however, can offer more than gold itself. People enjoy them for their beautiful designs and stories from the past.4 They come in different sizes and weights, starting from 1/20 oz up to 1 oz.4 Most are also at least 99.5% pure gold.3

4 Collectors and investors like them because they can add variety with their designs, ages, and cultures.4 They can mean a lot to people if they’re passed down or given as gifts. Rare or historic gold coins might go up in value because of their history.4

This article goes into detail about both gold bars and gold coins. It aims to help people choose what’s best for their investment goals.

The Manufacturing Process: Cast vs. Minted blocks of gold

There are two main ways gold bars are made: casting and minting. Cast gold bars are formed by pouring molten gold into molds. This produces bars with a rough, natural look, including imperfections.5

Because of their process, cast gold bars are often cheaper. This makes them a top choice for those who want to grow their gold collection.567

Cast Bars: Rugged Authenticity

The casting method has a history over 6,000 years old, showing its deep roots.7 It can create bars weighing up to 400 troy ounces. This means they come in various sizes, unlike minted bars.7

Because they are simpler to make, cast bars are often sold closer to the gold’s market price.6 Yet, they might have marks or uneven spots from the casting. These can lower their value when reselling.5

Minted Bars: Precision and Elegance

Minted gold bars follow a more detailed process. They entail exact rolling, cutting, and stamping to get a smooth and even look.5 Minted bars cost more than cast bars due to their sought-after beauty and designs.56 They feature intricate designs, which sets them apart from cast bars.6

Not only do minted bars look more elegant, but they are also easier to verify and trade.7 This adds to their appeal for collectors and investors.5 minted bars usually keep a good resale value because of their high quality.6 But, they are pricier upfront. This might not fit every budget compared to cast bars.6

The making of minted bars takes time, because of the careful steps to ensure they meet exact size and weight.6 They usually come packaged with a certificate and assay details. This offers security and makes trading easier.7

When choosing between cast and minted bars, investors should look into what fits their goals in the gold market.5

Factors Influencing the Value of blocks of gold

The value of

gold bars

is influenced by several key factors, including the

,

supply and demand dynamics

, and the

For a gold bar to be a good investment, it must be really pure. It should be 995.0 parts per thousand pure gold, which is almost the purest you can get.8 The gold’s spot price sets the basic value for these bars. But extra costs are added to making and selling them.8 The size of the bar also matters a lot. Bigger bars often cost less per unit weight than smaller ones.8 This can be a key point for investors looking to buy gold bars.

Gold Content and Purity

Gold content and purity are very important in determining a gold bar’s worth. In the investment world, gold bars must be super pure—at least 99.5% pure gold.8 This high purity means the gold is precious and a great choice for people who want to keep their money safe.

Supply and Demand Dynamics

The supply and demand dynamics of gold greatly affect gold bar values.89 Things like how much gold is being mined, how much central banks are buying, and what consumers want for jewelry and tech influence this.89 When these things change, it affects the price of gold and, in turn, gold bars.

Weight and Size Considerations

The weight and size of a gold bar is important, too.8 The bigger the bar, like a 400-ounce one, the less you pay extra per ounce. This makes them cheaper for their size. Bigger bars are a better choice if you’re buying a lot of gold at once.

Knowing these key points about gold bars can help you make smart choices and ensure the best value when buying gold bars for your collection.

Choosing the Right blocks of gold for Your Portfolio

When selecting gold bars for investment, it’s important to match them with your goals and risk tolerance.10 Think about what size gold bars are best for you. This includes looking at the cost and how easy it is to turn them into cash.10 Bigger bars are cheaper but harder to sell in parts. Smaller ones cost more but are easier to sell in smaller amounts.

To optimize gold bar investments, this article helps you understand your needs. It then shows how to pick the right gold bars for your financial plan.10 By choosing wisely, you make sure your gold helps you reach your money goals over time.10

11 Gold has been used as money for centuries. It’s often advised as a way to make a stock and bond mix less risky because it doesn’t always go up or down with them.11 But,10 investing in gold and other raw materials is risky and not everyone should do it.10

11 These kinds of investments can be much more up and down than stocks or bonds. Plus, money put into futures and forex isn’t safe from big loss by the SIPC.11 So, knowing how much risk you’re comfortable with and what you want out of investing is key when choosing gold bars.11

Storage and Security: Protecting Your Golden Assets

Proper

and security are key when you buy physical gold. You’ve got various ways to keep your gold safe, each with pros and cons.

Private Vaults and Safes

If you really want to keep your gold safe, private vaults and safes are for you.12 They use top-notch security like fingerprint scanners, cameras, and extra systems in case something goes wrong.13 So, if you worry about your gold, a private vault or safe will give you peace of mind.

Professional Storage Facilities

Another option is letting the pros handle your gold. Reputable dealers and special custodians can take care of it for you.13 They use the best security and make sure your gold is covered by insurance.13 Though you might not get to see your gold often, they provide a complete way to keep it safe.

Learning about the different private gold vaults and professional gold storage services helps you make smart choices.1312 This article looks at what you need to know to keep your gold secure, so you can protect your investment from risks.

Buying and Selling blocks of gold: A Guide

Getting or getting rid of gold bars requires caution to work with trusted sources.14 Places like the Royal Canadian Mint and PAMP Suisse are good choices.14 Choosing well-known dealers makes the process smoother.

Reputable Dealers and Mints

If you’re thinking of buying gold bars, go for top dealers and mints.14 Johnson Matthey and PAMP Suisse are famous for their pure gold bars.14 This way, you know your investment is in good hands.

Online Marketplaces and Auctions

Looking online for gold bars is another option.14 But, be careful. Always check the authenticity of the seller and bar.14 Abe Mor is a trusted online dealer for fair prices and good service.

Choosing the right path in the gold bar market is critical.15 The worth of a gold bar changes by its gold level, weight, state, and design.15 Know these points well to make smart investments in gold bars. With a good strategy, you can strengthen your portfolio with gold bars.

Tax Implications and Legal Considerations

Investors must think about taxes and laws when buying gold bars. How gold is taxed changes by place; some spots like it, and some don’t. They might tax you when you sell it, too.16

In the U.S., gold is seen as a “collectible” by the IRS. This makes its tax rate 28%, which is higher than other investment taxes. It also means you might pay more in income taxes if you sell within a year. The more you make, the more they might take.16

Knowing the rules for owning and moving gold bars is important. Some places need you to report it or have limits on how much you can have or move.16

This info is key for following the law and paying less tax on gold bars. It lets investors make smart choices. They can plan better for their financial future this way.16

Conclusion

This guide has explored the world of authentic blocks of gold, known as gold bars. It has shown you why people love gold for its value over time. Gold has always been special to people worldwide.17 We looked at what makes gold bars different from gold coins, how they’re made, and what affects their value. This includes things like their gold content, how pure they are, and trends in supply and demand.17

You can be smart about investing in gold bars from what you’ve learned here. This advice is good for both new and experienced investors. The article offers tips on buying, storing, and keeping your gold bars safe.

Gold prices change a lot. They hit $1,875 an ounce in January 2023, then jumped from about $1,656 an ounce in September 2022.17. Until the 1970s, the U.S. backed its money with gold. Companies such as Barrick Gold Corp., Newmont Corp., and Agnico Eagle Mines Ltd. are popular to invest in. So are exchange-traded funds (ETFs) like SPDR Gold Shares (GLD), which let you invest in gold without buying the actual bars.17 Knowing how the gold market works and smart investment tips will help you make better gold bar investment choices. This allows you to feel more secure about your decisions in the gold market.