Welcome to our comprehensive guide on the 1 kilo of silver price, offering you real-time updates on the current value of silver. As an investor, staying informed about today’s silver price is crucial for making strategic investment decisions. In this article, we will provide you with the latest updates on the cost per kilo of silver and insights into historical data and long-term pricing trends.

At Minerals Base Agency, we understand the importance of accurate and up-to-date information. That’s why we offer a live silver spot price chart that provides real-time updates on the price per kilo of silver in Zurich, London, Singapore, and Toronto. Our chart processes updates every 10 seconds, ensuring you have the most current data at your fingertips.

Our spot price chart offers real-time updates and provides historical data spanning up to 20 years. This allows you to analyze long-term pricing trends and gain valuable insights into the silver market. Whether you are a seasoned investor or just starting, our chart will help you make informed decisions based on accurate data.

At Minerals Base Agency, we go beyond just providing information. We offer direct access to wholesale silver at competitive prices. You can place your orders quickly and conveniently through our live order board. We aim to empower you with the tools and resources to navigate the silver market and maximise your investments.

Stay tuned as we delve deeper into the live silver spot price, buying and storing 1 kilo of silver, the benefits of 1 kilo of silver bars, and much more. By the end of this article, you will have all the knowledge you need to navigate the world of silver investments confidently. Let’s get started!

Live Silver Spot Price Today

Today’s live silver spot price provides real-time updates on the current trading value of silver per kilo in the wholesale market. It is an essential metric for both investors and traders to stay informed about the latest price fluctuations.

At Minerals Base Agency, you can access the live silver spot price today in multiple currencies, making it convenient for investors worldwide. The spot price represents the average of wholesale quotes and reflects the midpoint between buy and sell prices, ensuring transparency and accuracy in pricing.

Private investors can make well-informed decisions about buying or selling silver based on the most up-to-date market information by monitoring the live silver spot price. Minerals Base Agency’s live order board allows investors to set their silver prices, enabling them to take advantage of trading spreads.

Investing in silver is a strategic way to diversify your portfolio and potentially benefit from the stability and growth of the precious metals market. By staying updated on the real-time silver spot price, you can seize opportunities for value investing and capitalize on market trends.

To help you visualize the current silver spot price, here is a live chart:

Tracking the real-time silver price is essential as an investor, as it can significantly influence your investment decisions. Whether you are considering buying or selling silver, having access to the live spot price today allows you to stay ahead of market movements and make informed choices.

Buying and Storing 1 Kilo of Silver

Purchasing one kilo of silver is a cost-effective way to add a substantial amount to your investment portfolio. The larger kilo bar reduces the premium per ounce compared to smaller bars, allowing you to maximize your investment. With its high liquidity and intrinsic value, silver is an attractive asset for diversifying your portfolio.

- Cost-effective: The larger 1-kilo bar minimizes the premium per ounce, providing a more affordable investment option than smaller bars.

- Accessible: You can purchase 1 kilo of silver bars from reputable dealers or online platforms like Minerals Base Agency, offering convenience and transparency.

- Secure: Buying silver from established sellers ensures the authenticity and quality of the metal, protecting your investment.

Storing silver bullion:

- Home storage: You can easily stack and organize 1 kilo of silver bars in a home vault or secure location, granting you control over their storage.

- Third-party storage: If you prefer professional storage, Minerals Base Agency offers secure vaults for storing your silver, safeguarding your investment.

- Insurance: Whether you choose home or third-party storage, you should secure insurance coverage to protect against unforeseen events.

Silver storage fees:

It’s crucial to be aware of any associated fees when considering storage options. Minerals Base Agency offers low storage fees, allowing you to safeguard your silver without incurring significant costs. You can calculate the commission and storage fees using their cost calculator.

Benefits of 1 Kilo Silver Bars

Investing in 1 kilo silver bars offers numerous advantages for experienced and beginner investors. These larger bars provide a cost-effective way to add significant quantities of silver to your investment portfolio, making them an ideal choice for those purchasing silver in bulk. Compared to smaller bars, 1 kilo silver bars typically have lower premiums per ounce, allowing investors to maximize their purchasing power.

One of the key benefits of investing in silver bars is their high liquidity. The bullion market for silver is highly active and easily accessible, so selling your silver bars can be quick and straightforward. This liquidity makes silver bars an attractive option for investors who value the ability to convert their assets into cash when needed quickly.

Aside from the financial advantages, owning physical silver in the form of 1 kilo silver bars provides a sense of privacy and control over your investment. Unlike stocks or digital assets, physical silver can be stored securely in your private vault or a trusted storage facility. This physical ownership gives you complete control over the storage and security of your silver investment, providing peace of mind and protection against potential risks.

Overall, the benefits of 1 kilo silver bars are evident. They offer an affordable and cost-effective way to invest in silver while providing high liquidity and the added security of physical ownership. Whether you are a seasoned investor or just starting, adding 1 kilo of silver bars to your investment portfolio can help diversify your holdings and potentially enhance your long-term financial goals.

The Future Price of 1 Kilo of Silver

Predicting the price of 1 kilo of silver can be challenging due to the fluctuating nature of bullion prices. As with any investment, silver prices are influenced by various factors that can impact its value over time. These factors include supply and demand dynamics, industrial demand, monetary policy, inflation, and overall market performance.

While it is impossible to forecast the future price of silver accurately, investors can analyze historical data and track real-time silver prices to gain insights into price trends. By monitoring the live silver price chart provided by the Minerals Base Agency, investors can assess the current market conditions and make informed decisions.

The silver price projection for the future depends on various macroeconomic factors and market conditions. For example, an increase in industrial demand for silver, driven by advancements in technology or the growth of renewable energy, may lead to a potential increase in the price of silver. On the other hand, a decline in demand or an increase in the supply of silver may affect its price negatively.

It is important to note that projections and forecasts are not 100% reliable, as unpredictable events and market behaviour can influence the silver market. Therefore, investors should exercise caution and diversify their investment portfolio to mitigate risks.

Silver Price Trends

- Historical data shows that silver prices have experienced long-term upward trends and periods of volatility.

- During economic instability or uncertainty, silver has often been sought after as a safe-haven asset, which can lead to an increase in its price.

- Silver prices can also be influenced by factors such as changes in interest rates, geopolitical events, and inflation.

- Investors can analyze silver price trends over different timeframes, including short-term fluctuations and long-term patterns, to gain insights into potential future price movements.

While predicting the future price of silver is challenging, staying informed about silver price trends and market dynamics can help investors make educated decisions and navigate the volatile silver market.

Silver as a Store of Value

Silver has a long history of being a reliable store of value. Its intrinsic value is driven by industrial demand and its historical use as a medium of exchange. Unlike fiat currencies, which can be subject to inflation and devaluation, silver provides a tangible, physical asset that holds its worth over time.

Investing in silver can be a smart long-term investment strategy. As a precious metal, silver has proven to retain its value and even increase in price over the years. It is a hedge against economic uncertainty and volatility, making it an attractive option for those looking to protect and grow their wealth.

One key advantage of owning 1 kilo silver bars is the ability to store a significant amount of wealth in a relatively small physical space. These bars are compact and easily stackable, allowing investors to securely store large amounts of silver. Whether kept in a home vault or stored in a secure facility, owning physical silver provides peace of mind and diversification in an investment portfolio.

Benefits of Silver as a Long-Term Investment

- Safe-Haven Asset: Silver has a track record of being a safe-haven asset during economic turmoil. Its value rises when traditional investments, such as stocks and bonds, experience volatility. Therefore, it serves as a reliable store of value.

- Intrinsic Value: Silver’s value extends beyond its use as a precious metal. It is critical in various industries, including electronics, solar power, and medical applications. This industrial demand provides intrinsic value to silver, ensuring its continued relevance and worth.

- Liquidity: Silver is highly liquid, meaning it can be easily bought and sold in the marketplace. This liquidity translates into the ability to quickly convert silver into cash when needed, offering flexibility to investors.

- Portfolio Diversification: Investing in silver provides diversification benefits to an investment portfolio. By including silver in a well-rounded portfolio, investors can reduce risk and potentially increase overall returns.

Silver’s status as a store of value and its long-term investment potential make it an attractive option for investors seeking to secure their wealth and diversify their portfolios.

1 Kilo Silver Bar Specifications

When investing in silver, 1 kilo silver bars are popular among investors. Reputable private mints produce these bars and often hold certifications from global trading markets such as the LBMA (London Bullion Market Association) and COMEX (Commodity Exchange).

One advantage of investing in secondary market silver bars is the possibility of purchasing them at lower premiums than newly minted bars. Depending on the manufacturer and available inventory, these secondary market bars may have unique designs on the obverse and reverse sides.

Each 1 kilo silver bar contains approximately 32.15 troy ounces of pure silver with a minimum purity level of 999. This ensures that the bar is high-quality silver, making it a desirable asset for investors.

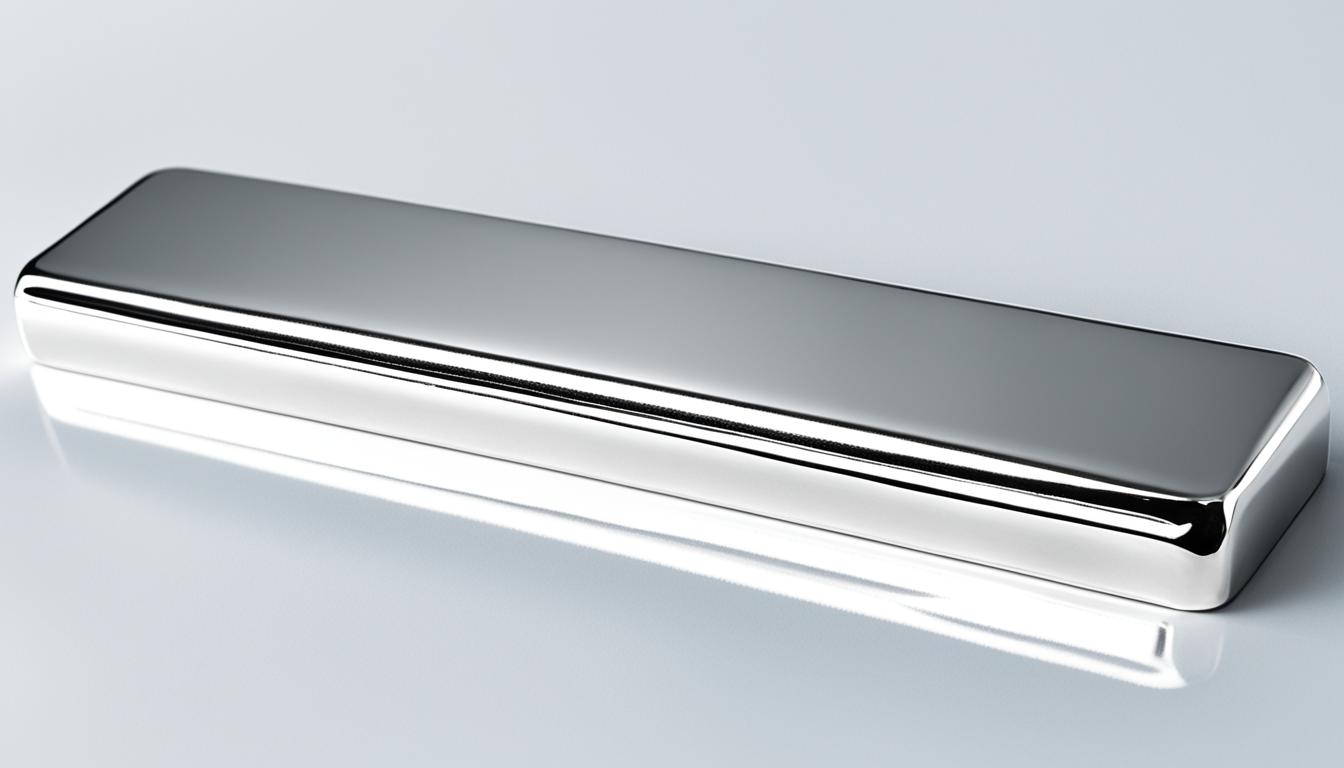

To give you a visual representation of a 1 kilo silver bar, take a look at the image below:

As you can see, the 1 kilo silver bar is a substantial piece of precious metal, offering both investment potential and intrinsic value.

Buying Silver Kilos at the Best Price

Finding the best price when buying 1 kilo silver bars is crucial. By comparing prices among reputable bullion dealers, investors can ensure they get the most value. One effective tool for price comparison is FindBullionPrices.com, which allows investors to compare prices and easily find the lowest premium per ounce.

Buying silver kilos in bulk is another way to maximize savings. Kilo silver bars generally offer lower premiums per ounce compared to smaller increments, which means investors can enjoy the benefits of a reduced price per ounce when purchasing larger quantities.

Investors can make the most cost-effective purchase by carefully considering the lowest price per ounce and taking advantage of bulk buying opportunities. This allows them to acquire silver kilos at the best price, ensuring their investments align with their financial goals.

Why Buy Silver Kilos?

- Lower premiums per ounce compared to smaller bars

- Savings on a larger scale with bulk buying

- Potential for higher liquidity in the bullion market

- Cost-effective way to add a significant amount of silver to your investment portfolio

Investing in Silver Kilos

Investing in silver kilos is a wise choice for individuals looking to diversify their investment portfolio while taking advantage of silver’s intrinsic value. Silver is a precious metal and a crucial industrial material used in various sectors, such as electronics and jewellery. This dual demand creates a stable market for silver, making it an attractive long-term investment option.

Kilo silver bars offer a secure and convenient solution for storing silver bullion. These bars can be stacked and stored at home or in a secure facility. Their larger size allows for efficient storage, making them ideal for investors looking to accumulate a substantial amount of silver.

The liquidity of silver kilos is another advantage for investors. These bars can be easily bought and sold in the bullion market, providing flexibility and ensuring quick access to cash when needed. This liquidity factor allows you to react to market conditions and exploit opportunities to buy or sell silver.

The Intrinsic Value of Silver

Silver’s intrinsic value is derived from its status as a precious metal and its diverse uses across multiple industries. Silver is a tangible asset with a unique allure that has withstood the test of time. Its historical significance and practical applications make it an attractive option for those looking to protect their wealth.

By investing in silver kilos, you can acquire a substantial amount of this valuable metal, offering a hedge against inflation and economic uncertainty. Silver has proven to retain its value over the long term, making it an excellent store of wealth.

Diversifying Your Investment Portfolio

One key advantage of investing in silver kilos is the diversification it brings to your investment portfolio. Including silver in your asset allocation strategy reduces your exposure to traditional financial instruments and potentially enhances portfolio performance. Silver’s low correlation with other assets makes it an effective tool for risk management and achieving a well-balanced investment portfolio.

When considering silver kilos as an investment, it’s essential to research reputable suppliers and storage options. Look for trusted dealers with a proven track record and consider utilizing secure storage facilities to ensure the safety and integrity of your investment.

Overall, investing in silver kilos allows you to tap into silver’s intrinsic value while diversifying your investment portfolio. With its stability, liquidity, and potential for long-term growth, silver kilos are an attractive investment option for seasoned investors and those entering the precious metals market.

Conclusion

In conclusion, tracking the 1 kilo silver price is crucial for investors making informed decisions about their silver investments. Minerals Base Agency’s live silver price chart provides real-time updates and historical data, enabling investors to monitor price trends and analyze market behaviour.

1 kilo silver bars offer a cost-effective and convenient option for purchasing and storing silver. With lower premiums per ounce than smaller bars, investors can maximize their purchasing power and add bulk ounces of silver to their investment portfolio.

When considering a silver investment, various factors, such as the price per ounce, liquidity, and intrinsic value, must be considered. By evaluating these aspects, investors can make strategic choices that align with their financial goals.

By staying informed and considering the value of 1 kilo of silver bars, investors can make informed investment decisions and benefit from silver’s long-term potential as a store of value.