The shine of precious metals draws smart people. Knowing the 100g 24K gold price is key for gold investors. Gold is valuable and can protect money from losing value. But, you must be careful and plan for the gold market.

Markets change a lot. Smart investors stay up-to-date on trends and prices. Learning about the 100g 24K gold price helps you make smart choices. This helps balance the chances of winning or losing. It’s about finding great chances to make money. Investing in gold can help keep your money safe.

It’s an excellent time to shine in investing. Gold is always wanted, and not much is out there. Intelligent investors can find ways to grow. Learn about the market. Plan well by watching the 100g 24K gold price. It guides those who invest wisely.

Understanding the Market for 100g 24K Gold Bars

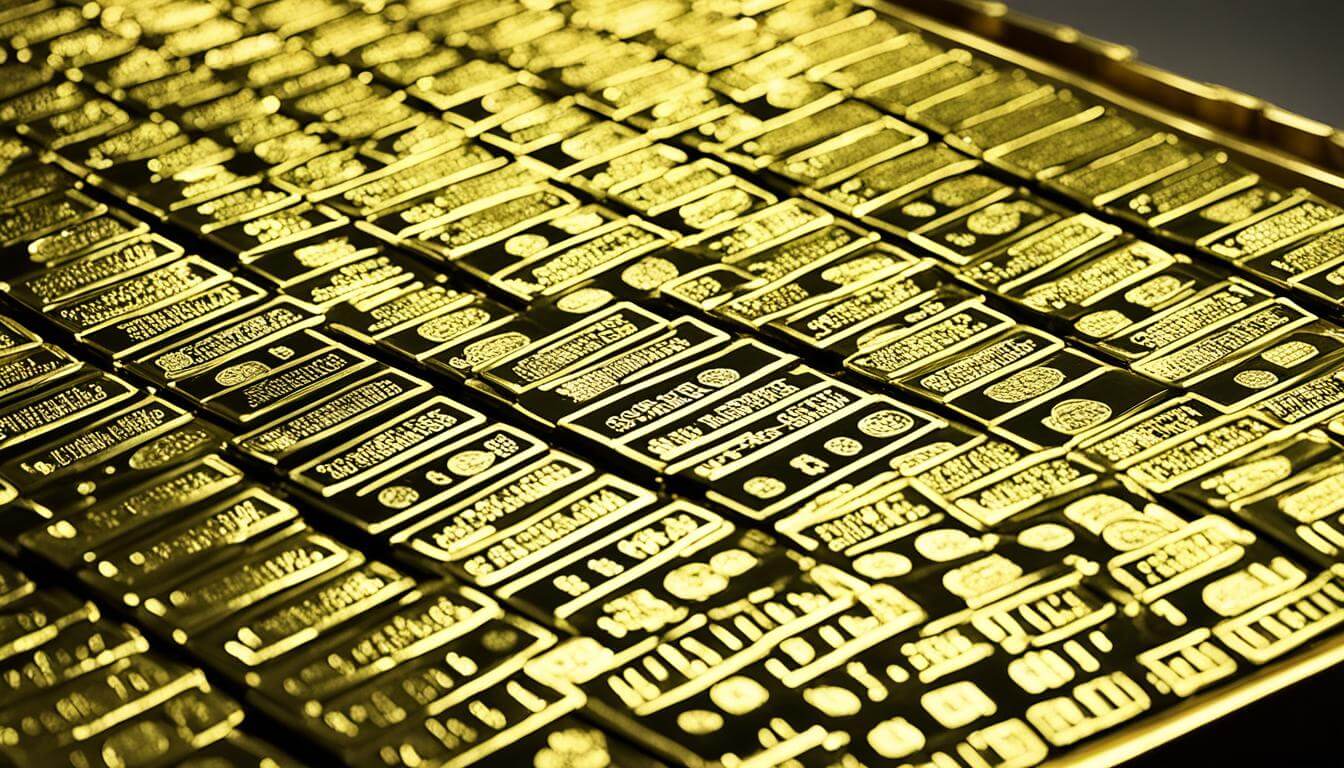

Gold bars weighing 100g are prized in the gold market. They offer a solid choice for those wanting real and safe investments. This market’s complexity reveals essential factors. These factors show why it’s a smart investment choice.

Factors Influencing the Gold Market

The gold market is affected by many factors. Inflation and global tensions matter a lot. Supply and demand also play a big role. They decide on gold’s price changes.

Why 100g Gold Bars are a Popular Investment Choice

100g gold bars stand for more than wealth. They are liked for their size, price, and ease of trade. This makes them ideal for both new and expert investors. You can buy, sell, and keep them easily. So, they’re a great investment choice for saving or extensive portfolios.

Comparing Premiums Across Different Brands

Different brands have different gold premiums. Premiums are extra costs on top of gold’s current price. They reflect things like making costs and the brand’s fame. Knowing these can help investors make intelligent choices and find the best deal.

- Analyzing premium trends among leading mints can highlight opportunities for cost-efficiency.

- Liquidity and market recognition of certain brands can influence the premium, painting a picture of market sentiment and preference.

- Investors may weigh the trade-off between higher premiums and the potential long-term value retention reputable brands offer.

Understanding gold premiums is key for investors. It helps them maximize the lasting value of 100g gold bars.

The 100g 24k Gold Price – Current Insights and Trends

People interested in the 100g 24K gold price find the market exciting but complex. They need to understand the market to make smart choices. Looking closely at gold prices shows how they connect to the economy. This shows how people feel about investing and how the world’s economy affects gold.

The changes in the 100g 24K gold price come from many sources. Things happening worldwide, like inflation changes, impact gold prices. These changes show how new and old economies are doing right now.

Experts examine these price changes closely to explain gold price trends. They see how economic changes can make gold more or less attractive. For example, when inflation increases, people might want gold more as protection. But if the economy looks good, gold might not seem as important.

- Gold’s true value doesn’t change, even when money values do.

- People often see gold as a way to protect against inflation.

- When people make predictions, they think about how stable the world is.

Today’s insights are based on many things, like how the world’s economy is doing. Knowing these things is very important for investors who want to understand the 100g 24K gold price better. Investors can find good chances in the gold market by looking at what happened before and what’s happening now. This market is always changing and full of possibilities.

Diversifying Your Portfolio with Gold Investments

Smart investors look for ways to make their money safe. They use portfolio diversification. Adding gold investments helps protect against ups and downs in the market. It shows you’re serious about managing risk. So, how much gold should you have? It depends on your asset allocation plan.

Gold’s Role in Risk Management

Investors often worry about global economic troubles and market ups and downs. Gold keeps its value well. It has done well when the economy was down. It helps protect your money, making gold an intelligent choice for your asset allocation.

Assessing the Right Allocation for Gold in Your Portfolio

Finding the best right allocation for gold might seem hard. Yet, it’s based on a few things: your goals, risk level, and the market. Here’s an easy way to figure it out:

- Think about your investment objectives. Are you looking for safety over the long haul or quick profits? Gold is great for long-term plans.

- Look at your risk tolerance. Do you like taking big risks for big rewards or prefer steady growth? Your risk tolerance affects how much gold you should have.

- Pay attention to market conditions. Economic signs, inflation, and world events can change gold prices. Even if these things are hard to predict, they can help decide how much gold to keep.

Using gold as a key part of portfolio diversification can make you less open to economic surprises. It sets you up for both small and big financial wins. The key to investing isn’t just picking the right things to invest in. It’s also about making them work well together in your portfolio.

Advantages of Investing in Physical Gold Over Other Assets

Investing in physical gold helps keep wealth safe and makes investment portfolios varied. Gold is real and has kept its value for a long time. It is a good choice for smart investors. It keeps its worth, even when other investments lose value.

Gold is special because you can hold it. This means it’s safe in a way that digital or paper investments are not. Gold also avoids digital dangers like hacking.

Gold stands apart from the regular financial world. It often gains value when stocks lose it. Because of this, many choose gold to protect against bad stock markets and inflation.

- Gold is a safe choice during hard economic times and big global issues.

- Gold is so valuable that governments and banks worldwide keep it as a reserve.

- Since gold is physical, it doesn’t depend on another’s promise to keep its value.

Unlike some digital things, gold won’t lose value because of new technologies. In a fast-changing world, gold’s constant value offers balance.

- Gold is also valuable in history and culture, often passed down in families.

- Gold gives you full control to sell whenever you want.

Investing in physical gold is like having a safe place for your money. It’s always valued and gives solid security. As the world changes, gold remains a smart choice for everyone’s future.

Exploring Top Gold Bullion Brands and Their Offerings

Adding gold to your portfolio is special. But choosing the right gold bullion brand is key. The brand’s reputation is as important as the gold’s purity and weight.

Brands like PAMP Suisse, Valcambi Mint, Heraeus, and Credit Suisse stand out. They are known for their quality and craftsmanship. They bring trust and confidence to gold investors worldwide.

PAMP Suisse: Elegance and Trusted Purity

PAMP Suisse stands for excellence. Located in Switzerland, this gold bullion brand is famous for its high-quality gold bars. Their bars aren’t just investments; they’re also art pieces. The Lady Fortuna design is quite famous.

The Valcambi Mint: A Blend of Tradition and Innovation

The Valcambi Mint mixes old Swiss traditions with new ideas to create gold bars that investors want. Valcambi is known for being very precise and careful when making its products.

Heraeus and Credit Suisse: Legacy in Bullion Excellence

Heraeus has been around for over 160 years. Its bullion bars are wanted for their purity and long history. Credit Suisse is similar but is supported by the Credit Suisse Bank. Their gold bars carry a rich Swiss banking history. Both are excellent choices for gold investors.

To sum up, investing in gold means trusting a good brand. You could choose PAMP Suisse, Valcambi Mint, Heraeus, or Credit Suisse. These brands are like gold in the bullion market. When you pick one, you like quality, which is appreciated by investors all over the world.

Navigating Taxes and Fees When Purchasing Gold Bullion

Many people buy gold to save money for the future. It’s a good plan against rising prices. But understanding gold bullion taxes and purchase fees is key when you start. This knowledge helps you avoid extra costs that can lower your gains.

It is crucial to look into the extra costs of buying gold. These could be dealer fees or a percentage of the gold price. Knowing about purchase fees helps you find the best deals and save money.

In the U.S., gold tax rules change based on where you are. Some places tax your gold buys, while others don’t. When you sell the gold, how much you’ve made and how long you’ve had it decides if you owe more taxes.

- Learn the tax rules in your place or ask a money expert about sales taxes and selling gold.

- Keep notes of all fees and taxes you pay. It helps come tax time.

- Think about all costs to know what you might earn from your gold.

Putting gold in your savings mix comes with costs to consider. Knowing gold bullion taxes and fees makes it more accessible. With research or help from pros, you can manage these extra expenses. This careful planning boosts your gold investment’s value.

Methods to Verify Authenticity and Purity of Gold Bars

Gold bars’ value depends on whether they’re real or pure. To protect your gold, you must know how to check them. Knowing real hallmarks and certifications can prevent big mistakes. Also, assay cards are essential. They prove your gold bar is worth what you think.

Understanding Hallmarks and Certifications

Hallmarks are marks on gold bars. They show how pure the gold is. They are recognized around the world. They help fight fakes. Certifications also matter a lot. They prove a bar’s purity and weight were checked by a trusted source. Groups like LBMA and Nymex set high standards for gold bars. Their support means a lot.

The Importance of Assay Cards and Their Significance

An assay card is a big deal. It comes with many gold bars. It lists the bar’s weight, purity, and unique number. It might even have the assayer’s signature. These cards mean pros checked the gold. They keep your gold’s value high. They are instrumental if you ever sell your gold.

- Always check for a hallmark and understand its elements

- Only buy gold bars with certifications from prestigious organizations

- Prioritize bars accompanied by secure, tamper-evident assay cards

In the end, hallmarks, certifications, and assay cards are key. They help investors check their gold is real and pure. It’s smart to learn about these checks. Or talk to experts who can help. This makes sure your gold investment is safe.

Gold Price Movement – Historical Analysis and Future Predictions

Exploring gold price history is fascinating. It shows how global economics and investment strategies link. Looking at market history, we understand what shapes its path. For example, quitting the Gold Standard in the 1970s changed gold’s value. This highlighted the vital link between economic policy and commodity prices.

The following decades had big moments. The 1970s inflation, 1980s geopolitical tensions, the 1990s tech boom, and the 2007-2008 financial crisis affected gold prices. These events changed how people see gold as a “haven.” This helps investors understand gold’s complex story.

Most analysts agree that past patterns are helpful when making future predictions. They show a theme of optimism followed by corrections in gold’s movement. We can find beneficial insights by studying past gold prices and current economic signs.

However, experts say not to rely only on historical analysis to predict the future. An intelligent approach also examines new factors like tech advances, supply chains, and global policies. Keeping these in mind helps make accurate future predictions. We blend history with a keen view of today’s economy.

- Brief retrospection of gold price spikes and dips

- Analysis of gold market responses to past economic crises

- Discussion on the impact of monetary policy changes on gold prices

- Expert interpretation of current market trends and data

- Predictive insights based on combined historical and present-day examination

To sum up, predicting the future of gold investments requires us to look back and ahead. We need views from both sides. This will help investors find great chances ahead.

When is the Right Time to Buy? Monitoring Gold Market Signals

Buying gold isn’t simple. It’s more like art. You need to watch the market closely and understand economic indicators well. Spotting the best time to buy gold may seem hard. But by analyzing the market, you can make smarter choices. This part discusses important signals. These signals help decide when to buy gold.

Reading Market Volatility

Market changes can help or challenge gold investors. It shows how gold prices move. A lot of change is a sign of the market’s mood. When market volatility is high, gold prices can change a lot. This is a chance for savvy investors to buy gold cheaper. You should watch the market well. This lets you buy gold at the best time.

Key Economic Indicators That Impact Gold Prices

Some economic indicators affect gold prices, like inflation rates. When inflation goes up, money is worth less, but gold’s value often goes up. When banks set low interest rates, gold looks better as an investment. That’s because holding gold costs less.

- Monitor inflation and consumer price index reports

- Keep a close eye on central bank announcements and interest rate changes

- Assess geopolitical stability, as unrest can lead to increased gold prices

Track these economic signals to buy gold at the right time. This way, you use market conditions to your advantage. No one knows the future for sure. But watching these indicators helps make suitable gold investments.

Conclusion

Let’s wrap up our discussion of gold. We learned a lot about gold investment. Gold is special and important for smart investors. We looked at how the gold market works. We talked about pure gold and big gold brands.

It’s time to consider smart investing. The ideas and plans we discussed are very important. They help us make good choices. When you pick gold bars or watch the market, think carefully. Doing research and asking experts is very smart.

This information is like a light showing the way to smart gold investing. Use what you learned. Make good plans and be sure. Now is the moment to act. Add gold to your investments wisely.