Investing in gold has long been a strategy for diversifying investment portfolios and as a hedge against inflation. Gold prices have fluctuated dramatically over the past century, influenced by factors such as inflation, geopolitical tensions, supply and demand, and mining and refining costs. It’s important to understand the historical fluctuations in gold prices and their correlation with other markets.

Market analysis is crucial for investors who want to stay informed about current gold trends. By closely monitoring gold price fluctuations, investors can make more informed decisions about their investments, taking into account various market conditions and factors that drive changes in gold prices. Conducting a comprehensive market analysis helps investors stay ahead and capitalize on potential opportunities.

The Benefits of Investing in Gold

Investing in gold can offer a hedge against inflation and provide diversification in a well-rounded investment portfolio. Gold has long been regarded as a store of value, with a rich history dating back centuries. It holds a unique allure that goes beyond its practical applications.

One of the primary benefits of gold investing is its ability to act as a hedge against inflation. In times of economic uncertainty and rising inflation, gold has proven to maintain its value or even appreciate. This makes gold an attractive investment option for those looking to protect their wealth and purchasing power.

Furthermore, gold provides diversification benefits by offering a different risk and return profile compared to other asset classes, such as stocks and bonds. When traditional investments experience volatility or decline in value, gold can serve as a stabilizing force in a portfolio, helping to reduce overall risk.

Investing in gold also provides a tangible asset that has no counterparty risk. Unlike stocks or bonds, which represent ownership in a company or debt instrument, gold is a physical asset with intrinsic value. This offers a sense of security and peace of mind to investors.

However, it’s essential to understand that investing in gold also comes with potential risks and drawbacks. The gold investment industry has seen instances of fraud and counterfeit products, making it crucial for investors to exercise caution and engage reputable dealers.

In summary, gold investing offers a range of benefits, including a hedge against inflation, diversification, and the security of owning a tangible asset. However, investors should carefully assess their risk tolerance and consider the potential drawbacks before entering the gold market.

Different Ways to Invest in Gold

Investing in gold offers various options for individuals looking to include this precious metal in their investment portfolios. From physical gold to gold ETFs and gold mining companies, each method has its own unique benefits and considerations.

1. Physical Gold

One of the traditional ways to invest in gold is by purchasing physical gold in the form of bars, coins, or jewelry. Physical gold provides tangible ownership and allows investors to have direct control over their assets. It can be stored in a safe deposit box or a secure location of choice. Many individuals choose physical gold as a long-term store of value and a potential hedge against inflation.

2. Gold ETFs

Gold Exchange-Traded Funds (ETFs) offer investors a convenient way to gain exposure to gold without physically owning the metal. Gold ETFs are investment funds listed on stock exchanges that track the price of gold. Investing in gold ETFs provides liquidity, ease of trading, and the ability to hold fractional shares. Additionally, gold ETFs eliminate the need for secure storage and transportation associated with physical gold ownership.

3. Gold Mining Companies

Investing in gold mining companies is another way to participate in the gold market. By purchasing stocks or shares of gold mining companies, investors indirectly benefit from the performance of these companies as they extract and sell gold. However, it’s important to note that investing in gold mining companies carries additional risks compared to physical gold or gold ETFs. Factors such as operational risks, geopolitical uncertainties, and company-specific challenges can impact the performance of gold mining company stocks.

Regardless of the chosen method, it’s essential for investors to conduct thorough research, understand the risks involved, and align their investment strategy with their financial goals and risk tolerance.

A Historical Perspective on Gold Prices

When making long-term investment decisions, it is important for investors to analyze historical gold prices to gain valuable insights into patterns and trends. By studying the historical performance of gold, investors can better understand how it has behaved in different economic and geopolitical conditions over time. However, it’s crucial to remember that past performance does not guarantee future results, as the specific circumstances and influences on gold prices can vary.

For a comprehensive understanding of historical gold prices, investors can refer to reliable sources such as Investopedia’s gold price history. This data provides a detailed overview of gold prices across different time periods, allowing investors to observe price fluctuations and identify potential trends.

By examining historical gold prices, investors can observe how gold has performed as an investment asset during various historical events, such as economic recessions, geopolitical tensions, and financial crises. This analysis can help investors make more informed decisions based on historical patterns and correlations between gold prices and external factors.

Key takeaways from analyzing historical gold prices:

- Gold prices have experienced significant fluctuations over the years, driven by a multitude of factors including economic conditions, geopolitical events, and supply and demand dynamics.

- When assessing long-term investment decisions, it is important to consider gold’s historical performance and its potential correlation with other asset classes.

- While historical gold prices can provide valuable insights, it is essential to combine them with current market analysis and individual investment goals and risk tolerance.

- Investors should remember that gold, like any other investment, carries its own set of risks and rewards, and should be approached with a well-diversified portfolio and a long-term perspective.

An appreciation of historical gold prices enables investors to assess the potential risks and rewards associated with investing in gold, and make more informed decisions to achieve their long-term investment objectives.

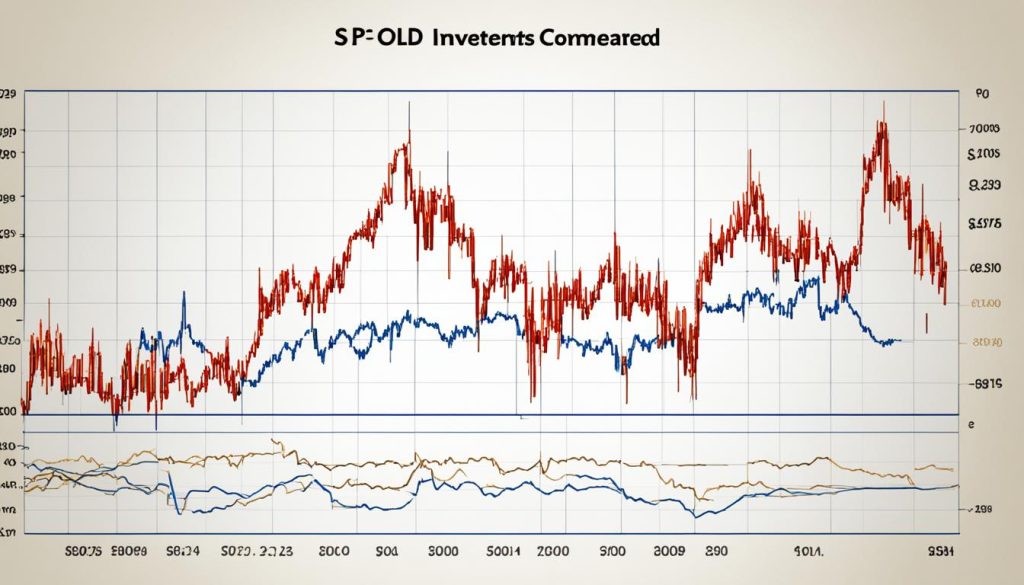

Gold vs. the S&P 500 Over Time

When considering long-term investment options, it’s essential to compare the performance of different assets to make informed decisions. One such comparison that investors often make is between gold and the S&P 500 index.

Gold performance has been closely watched over the years as it is considered a safe haven investment during times of market uncertainty. On the other hand, the S&P 500 represents the performance of 500 large-cap U.S. companies, providing investors with exposure to the stock market.

Over different time periods, the performance of gold and the S&P 500 can vary significantly. In some instances, gold may outperform the S&P 500, while in others, the S&P 500 may outperform gold.

Long-term investment comparison between gold and the S&P 500 requires considering various factors, including inflation and market conditions. Historical data analysis can provide insights into the performance of gold and the S&P 500, helping investors understand the potential risks and returns associated with each asset.

It’s worth noting that gold and the S&P 500 serve different purposes in an investment portfolio. Gold is often sought after as a hedge against inflation and a store of value, while the S&P 500 offers exposure to the growth potential of the U.S. stock market.

When making investment decisions, it’s crucial to evaluate individual goals, risk tolerance, and time horizon. A diversified investment strategy that includes both gold and the S&P 500 can help manage risk and potentially enhance long-term returns.

Inflation and Market Conditions

Inflation and market conditions have a significant impact on the performance of both gold and the S&P 500. Inflation erodes the purchasing power of fiat currency and often leads investors to seek out alternative assets like gold. During inflationary periods, gold may exhibit strong performance as investors turn to it as a hedge against rising prices.

On the other hand, the S&P 500’s performance is driven by economic factors, corporate earnings, and investor sentiment. Positive economic conditions and strong corporate earnings can fuel the growth of the stock market, and consequently, the S&P 500.

Comparing gold performance to the S&P 500 should consider the underlying factors influencing both assets, enabling investors to make well-informed decisions based on their investment objectives.

Notable Highs and Lows in Gold Prices

Gold prices have witnessed significant fluctuations throughout history, driven by various historical events and market influences. These notable highs and lows in gold prices serve as milestones, reflecting the impact of significant economic and geopolitical events on the precious metal’s value.

One such event was the end of the Bretton Woods system in the early 1970s, which marked a shift from the gold standard and contributed to a surge in gold prices. As the global monetary system transitioned to fiat currencies, investors sought gold as a store of value and protection against inflation.

The Great Recession of 2008 also had a profound impact on gold prices. As financial markets and economies plunged into turmoil, investors turned to gold as a safe haven asset, driving its price to new heights. During this period, gold reached its highest nominal price, reflecting the increased demand for this precious metal.

The COVID-19 pandemic, which began in early 2020, further highlighted the influence of historical events on gold prices. As uncertainty swept through global markets, gold once again gained prominence as a safe haven asset, shielded from the volatility and economic downturn caused by the pandemic.

These historical events and market influences have led to both notable highs and lows in gold prices. Understanding these milestones can provide valuable insights into the factors affecting gold’s value and its role as an investment asset.

Impact of Historical Events

The end of the Bretton Woods system, the Great Recession, and the COVID-19 pandemic are just a few examples of historical events that have shaped gold prices. However, it’s essential to recognize that gold’s value is also influenced by other market factors, such as supply and demand dynamics, geopolitical tensions, and overall investor sentiment.

For a detailed analysis of these events and their impact on gold prices, refer to the research by the Chicago Fed. This comprehensive study delves into the historical context of gold price fluctuations, providing valuable insights for investors seeking to understand the relationship between historical events, market influences, and gold prices.

As we explore further into the realm of gold, it becomes increasingly evident that its value is intricately tied to economic and geopolitical events. By recognizing and understanding these milestones, investors can gain a deeper insight into the complexities of gold prices and make more informed investment decisions.

Gold’s All-Time High

Gold reached an all-time high nominal price in April 2024. This milestone reflects the confidence and demand for this precious metal as an investment asset. However, it is essential to consider the impact of inflation when assessing the true value of gold.

When we adjust the nominal price of gold for inflation, we find that the all-time high was actually recorded in February 1980. This adjustment is crucial because it allows us to compare the purchasing power of gold across different time periods.

The inflation-adjusted price of gold provides a more accurate representation of its historical performance, accounting for the erosion of value caused by inflation over time. By considering the inflation-adjusted price, investors gain a clearer understanding of the true value and potential returns associated with gold investments.

Factors Influencing Gold Price Fluctuation

The price of gold is influenced by various factors that can impact its value in the market. These factors include:

- Macroeconomic Conditions: Fluctuations in the overall economy, such as changes in GDP, inflation rates, and interest rates, can affect the demand for gold as a safe haven investment. Gold often performs well during times of economic uncertainty and inflation.

- Geopolitical Tensions: Political instability, conflicts, and trade disputes can create uncertainty in global markets, leading investors to seek the perceived stability of gold. Geopolitical tensions can increase the demand for gold, driving up its price.

- Supply and Demand: The balance between the supply of gold and the demand for it plays a significant role in price fluctuations. If the demand for gold exceeds supply, prices tend to rise. Conversely, if supply outpaces demand, prices may decrease.

- Mining Costs: The cost of mining and refining gold is another crucial factor affecting its price. As mining costs increase, gold producers may adjust their selling prices, which can impact the overall gold market.

Investors who understand these factors can analyze market conditions and make more informed decisions about gold investments.

For more information on the current factors affecting gold prices, check out this article.

Correlation between Gold and Inflation

While gold is often considered a hedge against inflation, its relationship with inflation is weak. Although gold prices may rise during periods of high inflation, it’s important to note that other factors, such as interest rates and overall market volatility, can have a stronger influence on gold’s performance in the short run.

When it comes to gold’s role as an inflation hedge, it’s essential to understand the dynamics at play. Gold has historically been seen as a store of value, providing investors with a means to protect their purchasing power. However, the correlation between gold and inflation is not as strong as some may believe.

Interest rates play a significant role in the performance of gold in relation to inflation. When interest rates are low, the opportunity cost of holding gold decreases, making it more attractive as an investment. Conversely, when interest rates rise, investors may opt for interest-bearing securities over gold, which does not generate any interest income. This inverse correlation between gold and interest rates can influence gold’s performance as an inflation hedge.

Additionally, overall market volatility and investor sentiment can impact the performance of gold during inflationary periods. In times of high market uncertainty, investors may seek the stability and perceived safety of gold, thereby driving up its price. However, if market conditions stabilize and investor sentiment improves, the demand for gold as an inflation hedge may decrease.

While gold can provide some degree of protection against the erosion of purchasing power caused by inflation, it is important to consider the broader economic environment and market conditions when evaluating gold’s effectiveness as an inflation hedge. Investors should diversify their portfolios and consider a range of assets beyond gold to protect against inflation and mitigate risk.

Key Points:

- The relationship between gold and inflation is weak.

- Interest rates can influence gold’s performance as an inflation hedge.

- Market volatility and investor sentiment can impact gold during inflationary periods.

- Diversification and considering a range of assets are important for protecting against inflation.

Gold as a Risk On/Risk Off Asset

During times of economic and market uncertainty, gold is often sought after as a safe haven asset. Its reputation as a store of value makes it an attractive investment option for investors looking to protect their wealth. However, it’s important to note that gold’s performance can be influenced by several factors, including market volatility and investor sentiment.

Gold can be considered both a risk-on and risk-off asset, depending on the specific circumstances. In times of market volatility and heightened investor anxiety, gold tends to perform well as a safe haven asset. Investors flock to gold as a store of value when they perceive increased risks in other investment options. This demand for gold can drive up its price, making it a valuable asset for those seeking stability during uncertain times.

On the other hand, when market conditions improve and investor sentiment turns optimistic, gold may experience reduced demand. This shift in investor sentiment can be driven by various factors, such as positive economic indicators, the performance of other investment classes, or geopolitical stability. In such scenarios, investors may be more inclined to invest in riskier assets with higher potential returns, leading to a decrease in gold prices.

It’s important for investors to closely monitor market volatility, geopolitical events, and investor sentiment when considering gold as a safe haven asset. Market conditions and investor behavior can significantly impact the performance of gold as an investment. By understanding these dynamics, investors can make informed decisions and assess whether gold aligns with their investment objectives and risk tolerance.

Risk-On vs. Risk-Off Assets

- Risk-on assets: These are typically investments that perform well when investor sentiment is positive and there is an appetite for higher risk. Examples include stocks, high-yield bonds, and emerging market currencies.

- Risk-off assets: These are investments that are seen as more stable and tend to perform well during times of market volatility and economic uncertainty. Gold, along with government bonds, the Swiss franc, and the Japanese yen, is considered a risk-off asset.

Interest Rates and Gold Price Relationship

When it comes to gold prices, one factor that plays a significant role is the relationship between gold and interest rates. Over the long term, interest rates and the price of gold have an inverse correlation. This means that as interest rates rise, the demand for gold tends to decrease in comparison to interest-bearing securities.

The inverse correlation between gold and interest rates is based on the concept of opportunity cost. Holding gold does not generate any interest income, unlike interest-bearing securities. When interest rates rise, the potential return on these securities becomes more attractive, leading investors to shift their focus away from gold.

This relationship is particularly important for investors to consider as it influences their investment decisions. It highlights the impact of changes in monetary policy and economic conditions on the demand for gold. When interest rates are low, gold may become a more appealing investment option due to its potential for long-term growth and hedging against inflation.

However, it’s essential to note that other factors, such as geopolitical tensions, market volatility, and overall investor sentiment, can also influence the price of gold. Therefore, while the inverse relationship between gold and interest rates is a significant consideration, it’s crucial to analyze the broader economic and market landscape when making investment decisions related to gold.

Historical Perspective

- Historically, gold prices tend to rise when interest rates are low and fall when interest rates are high.

- During periods of high interest rates, investors may find alternative investments more attractive than gold due to the potential for higher returns.

- When interest rates are low, the opportunity cost of holding gold decreases, making it a potentially more valuable investment.

Understanding the relationship between gold and interest rates can provide valuable insights for investors looking to make informed decisions about their investment portfolios. By considering the impact of interest rates on gold prices, investors can better navigate the dynamic nature of the gold market and position themselves for potential opportunities.

Central Banks and Gold Prices

Central banks play a significant role in influencing gold prices through their actions. These institutions, responsible for implementing monetary policies, can impact the gold market through their decisions regarding gold holdings. When central banks reduce their gold holdings, it can lead to a decline in gold prices.

However, central banks need to manage their gold sales carefully to avoid disrupting the market. Sudden or large-scale divestments can create volatility and have a detrimental impact on gold prices. Therefore, central banks must carefully consider the timing and pace of their gold sales to maintain stable market conditions.

The relationship between central bank actions and gold prices is complex. While reducing gold holdings can put downward pressure on prices, the market also closely watches central bank actions for clues on economic health and stability. Market participants interpret central bank decisions as signals that can impact investor sentiment and influence gold prices accordingly.

The Market Impact of Central Bank Actions

When central banks buy or sell gold, the market closely monitors their activities. The announcement or execution of significant gold transactions by major central banks can have both immediate and long-term effects on gold prices.

Central bank actions can signal economic trends, financial stability, or impending policy changes. Large-scale gold purchases by central banks can be interpreted as a show of confidence in the precious metal, potentially driving up prices and attracting investor interest.

Conversely, when central banks sell significant amounts of gold, it may indicate a need for liquidity or a shift in investment preferences towards other assets. In such cases, gold prices may experience downward pressure due to increased supply in the market.

Furthermore, central bank actions can set the overall tone and sentiment in the gold market. Investor perception of central bank decisions can influence market participants’ confidence in gold as a safe haven asset or a hedge against inflation, impacting demand and prices accordingly.

Managing Gold Holdings

Central banks typically hold gold as part of their foreign exchange reserves. These reserves act as a safeguard against currency fluctuations, geopolitical risks, and economic uncertainties. Gold offers central banks a tangible and universally recognized store of value.

Central banks must carefully manage their gold holdings to balance their foreign exchange reserve requirements with other considerations, such as risk diversification and liquidity needs. Decisions regarding gold purchases or sales are often made strategically and in coordination with broader monetary and economic objectives.

Ultimately, central bank actions regarding gold holdings can have a significant market impact, influencing gold prices and shaping investor sentiment. Understanding these dynamics is crucial for investors seeking to navigate the gold market and make informed investment decisions.

The Role of ETFs in Gold Prices

Exchange-traded funds (ETFs) that track the price of gold play a significant role in the gold market. These investment vehicles are major buyers and sellers of gold, and their activities can have a profound impact on the supply and demand dynamics of the market.

Gold ETFs offer investors an opportunity to gain exposure to the performance of gold without having to physically own and store the precious metal. These funds hold gold bullion or trade derivatives linked to the price of gold, allowing investors to trade in and out of gold positions on stock exchanges.

ETFs can create additional demand for gold when investors buy shares in these funds. The purchase of ETF shares is typically accompanied by the creation of new physical gold holdings by the fund, leading to increased demand in the gold market. Conversely, when investors sell ETF shares, the fund may need to liquidate some of its gold holdings, potentially impacting the overall supply and demand balance.

Market Impact of Gold ETFs

The influence of gold ETFs on the market is further amplified by their ability to attract both retail and institutional investors. These funds offer a convenient and cost-effective way of gaining exposure to gold, making it accessible to a broader investor base.

When gold ETFs experience significant inflows, it can signal increased investor interest in gold and potentially drive up gold prices. Conversely, outflows from gold ETFs may suggest reduced demand and could put downward pressure on gold prices.

Supply and Demand Dynamics

The activities of gold ETFs can directly impact the supply and demand dynamics of the gold market. In times of uncertainty or economic instability, investors may turn to gold ETFs as a safe haven, leading to increased demand for gold. This increased demand can tighten the supply-demand balance, potentially resulting in upward price movements.

On the other hand, if investors shift their focus away from gold and towards other investment opportunities, it can lead to decreased demand for gold ETF shares. As a result, gold ETFs may need to sell some of their holdings, potentially increasing the supply of gold in the market and putting downward pressure on prices.

Overall, gold ETFs have become an important player in the gold market, with their activities capable of influencing supply, demand, and ultimately the price of gold. Investors should carefully monitor the activities of these funds as part of their analysis and decision-making process when considering gold investments.

Gold as Part of a Diversified Portfolio

When constructing an investment portfolio, diversification is key to managing risk and maximizing potential returns. Gold can play a valuable role in achieving this diversification by providing a hedge against market volatility and acting as a store of value. However, it’s crucial to carefully allocate gold within a portfolio to maintain a balanced and diversified approach.

Portfolio diversification involves spreading investments across different asset classes to reduce the impact of any single investment’s performance on the overall portfolio. Including gold as part of a diversified portfolio can help mitigate risk and enhance portfolio stability. Gold’s unique properties and historical performance indicate its potential to provide a safe haven during economic downturns and times of uncertainty.

Risk management is another important consideration in portfolio construction. Gold’s low correlation to other asset classes, such as stocks and bonds, can help reduce portfolio volatility and enhance risk-adjusted returns. By allocating a portion of the portfolio to gold, investors can potentially offset losses in other areas and achieve a more balanced risk profile.

It’s worth noting that the optimal allocation of gold within a portfolio may vary depending on an individual’s financial goals, risk tolerance, and investment horizon. Generally, experts recommend keeping gold allocation at around 10% or less of the total portfolio value.

It’s essential to evaluate your investment objectives and consult with a financial advisor to determine the appropriate allocation for gold within your specific portfolio. By incorporating gold into a well-diversified investment strategy, investors can potentially benefit from its risk management properties and potential returns.

Embedding the right percentage of gold in your investment portfolio contributes to effective portfolio diversification and risk management. To learn more about gold market trends and strategies for portfolio allocation, you can refer to this comprehensive resource.

Conclusion

In conclusion, understanding the fluctuations in the price of gold is essential for investors seeking to diversify their portfolios and hedge against inflation. The price of gold is influenced by various factors such as inflation, geopolitical tensions, supply and demand, and mining costs. While gold is often considered a safe haven asset, its performance can be influenced by other market factors as well.

By analyzing historical trends and the key drivers of gold prices, investors can make informed decisions about their gold investments. It’s important to note that gold’s correlation with inflation is weak and that other market conditions and investor sentiment can have a significant impact on its performance. It’s also crucial to carefully consider the allocation of gold within a diversified portfolio, typically no more than 10%, to maintain balance and manage risk.

To delve deeper into the nuances of gold price fluctuations and gain further insights, you can refer to the Chicago Fed Letter. This comprehensive resource provides market analysis, current gold trends, and valuable research that can aid in making strategic investment decisions.