Investors and finance experts keep a close eye on the current gold price. It’s crucial for understanding global economic health. The spot gold price shows the precious metal’s trading value right now, making the price per ounce today important for global transactions. Market forces shape this spot price, reflecting the world’s economic condition.

Grasping the spot gold price is key, whether for short-term or long-term plans. It ties back to supply and demand, plus geopolitical tensions. Knowing the price per ounce today helps you see the market’s mood. It also supports smart decision-making by predicting price trends in the metals market.

Unpacking the Definition of Spot Gold Price

The definition of spot gold price is used to show the value of gold ready for instant delivery. It shows how much gold is worth, based on current market conditions. Understanding this is key for anyone involved in the gold market.

What is Gold Spot Price?

The gold spot price is how much you can buy or sell gold for right away. It changes often, based on the nearest month’s futures contracts that are actively traded. This is because different factors affect the price all the time.

Calculation of Spot Prices

The calculation of spot prices depends on supply and demand. Things like the state of the world, money’s value, how well countries do, and gold mining affect it. Big markets like the LBMA and COMEX help set the worldwide spot price.

Gold Spot Price vs. Gold Futures

The difference between gold spot price vs. futures is about timing. Spot prices show what gold is worth now, but futures predict its future price. Futures involve buying or selling gold at a later date. They reflect guesses on future market moves and risks, leading to strategic bets and protection plans.

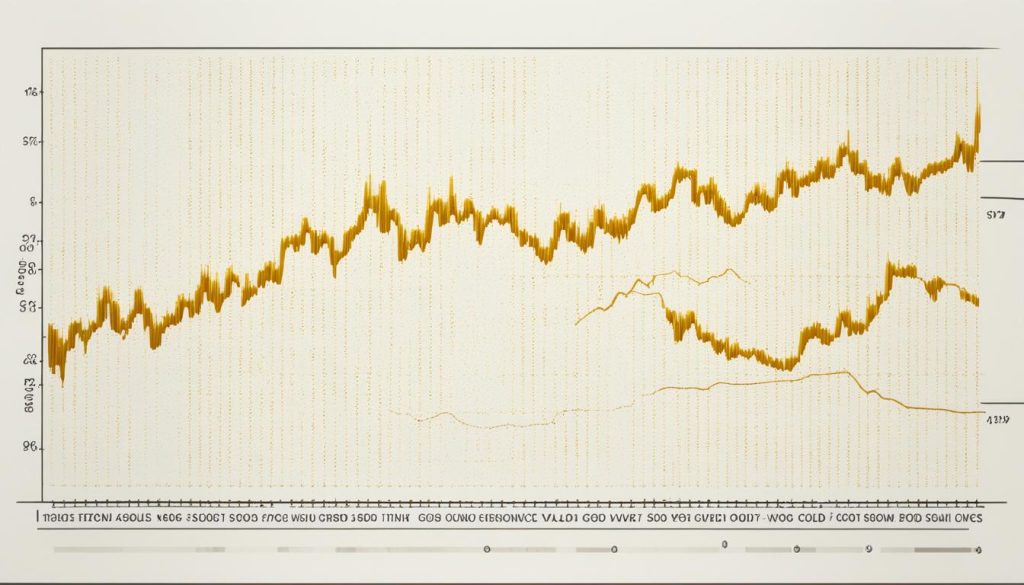

Historical Perspectives and Record Gold Prices

Gold is known for its rare and beautiful nature. It symbolizes wealth and has held value over time. The story of historical gold prices shows ups and downs. It highlights how economies and global finance are influenced. By looking at gold price milestones, we see important times when gold made news. Studying its performance over decades helps us understand why it is a top investment choice.

Gold Price Milestones

- The gold standard made a clear measure for gold’s value, linking it directly to currency.

- In 1944, the Bretton Woods agreement fixed gold at $35 an ounce. This helped set global currency values.

- When the gold standard ended in the 1970s, gold pricing became market-driven. This led to more price changes.

- The 2008 financial crisis proved gold is a safe place to put money during tough times.

- Record prices in 2011 and 2020 show gold’s reaction to global issues and economy policies.

Gold’s Performance Over Decades

- 1970s: After the gold standard ended, gold prices jumped. It marked gold’s move to market-based pricing.

- 1980s-1990s: Prices were more stable, but events like the Bre-X fraud affected trust in gold.

- 2000s: A bullish market began. Prices increased steadily due to global economic challenges.

- 2010s: Prices reached a high then dropped. This shows the up and down nature of commodities.

- 2020s: Recent global issues have sparked more interest in gold, increasing its investment appeal.

Gold has been a cornerstone in finance and a symbol of safety in hard times. Its performance over decades demonstrates lasting strength. This makes historical gold prices a continuously interesting and relevant subject for both investors and historians.

Examining the Economic Factors Affecting Gold Prices

Gold’s value comes from many economic factors affecting gold prices. These factors weave together, making gold stay important in the global economy. It’s always changing because of these factors.

The Impact of Interest Rates and Inflation

Gold and inflation have an opposite relationship. People see gold as a way to protect money value. Central banks change interest rates to manage inflation. This impacts gold directly.

When rates are low, people like gold more. This is because holding gold costs less compared to other investments. High rates make the currency stronger and gold less attractive. Low rates can mean economic problems, making gold a favored choice.

Knowing this helps us guess where gold prices may head. It’s crucial during changes in monetary policy.

Geopolitical Events and Market Stability

Geopolitical events also impact gold prices. They add to economic uncertainty, making gold more appealing. When there’s conflict or sanctions, people buy gold for safety. This pushes its price up.

Trade deals can change how people feel about investing. Changes in government or unsure elections can make gold prices go up. These make gold a popular choice during uncertain times.

To make smart gold investments, watch these economic and geopolitical factors closely. They help predict gold’s value.

In-Depth Look at Gold Derivatives and Their Costs

Investing in gold offers varied paths, each with pros and cons. The choice between physical gold vs gold ETFs and the intricate gold derivatives arena is vital. Both beginners and seasoned investors need to grasp these concepts to choose wisely.

Comparing Physical Gold to Gold ETFs

Physical gold provides a solid and secure investment that you can actually touch. On the other hand, gold ETFs are easier to get into without the hassle of handling real gold. But, deciding between the two involves looking at how you want to invest, your goals, and how you’ll manage your gold.

- Physical gold avoids the risk of others not meeting their part of the deal, offering a safe option in uncertain times.

- Gold ETFs can be bought and sold quickly, ideal for traders wanting fast action.

- Yet, gold ETFs can swing in value just like other market trades, which is important to remember.

This comparison sheds light on the difference between holding real gold and investing in gold-linked financial products.

The Hidden Costs of Gold Derivatives

Gold derivatives, including futures, options, and ETFs, can have costs that might surprise you. These extra fees can cut into profits and change how well your investments do. Knowing about these costs is key for making smart gold investment choices.

- Gold ETFs might add storage and insurance fees into their price, changing what they’re worth.

- Futures contracts have spreads that could mean paying more in transaction fees, affecting your gains.

- Also, ETFs might not always match gold’s actual price, which could lead to unexpected money loss.

Knowing the hidden costs of gold derivatives is crucial for gold market success.

The details of gold derivatives, physical gold, and ETFs highlight the need for careful investment planning. Investors should consider all costs and benefits. This helps in making a choice that fits their money goals and how much risk they can take.

The Mechanics Behind Setting Global Gold Spot Prices

The global gold spot prices are set through a complex system. It involves key organizations like the London Bullion Market Association (LBMA) and the Commodity Exchange, Inc. (COMEX). These groups are central to gold pricing. They operate detailed auction processes. These efforts ensure transparency in gold pricing and accuracy.

Role of the LBMA and COMEX in Gold Pricing

The LBMA is crucial in the gold market. It ensures that spot gold pricing is consistent and legitimate. It oversees the global OTC market. This enables a smooth, comprehensive network for trading gold. COMEX plays a key role too. It’s part of the New York Mercantile Exchange (NYMEX). COMEX adds large amounts to the gold futures market. It sets benchmarks that affect global gold spot prices worldwide.

Understanding Auction Processes and Transparency

Auction processes are key to setting prices. They involve a thorough mechanism. Gold prices are decided twice each day, known as the LBMA Gold Price. This provides a fair and equitable setup. It includes many participants, from central banks to private investors. The auction’s open setup builds trust. It offers a live insight into gold price changes. This shows their impact on markets and economies around the globe.

- LBMA’s auctions ensure a clear, orderly method in pricing.

- COMEX’s gold futures contracts indicate future global gold spot prices. They show what the market expects.

In short, setting global gold spot prices is done with precision. It’s due to the well-run moves of places like LBMA and COMEX. They handle auctions with transparency and skill. This system maintains the reliability of gold pricing. It is fundamental to keeping investors’ trust in the precious metals market.

The Symbiotic Relationship Between Gold and Silver Prices

The gold-silver relationship is fascinating to investors. For years, these two metals have moved together, showing a unique partnership. Investors use this relationship to shape their trading strategies. Knowing the gold to silver ratio helps those wanting to make the most of market changes. We will look at both modern tactics and the historical trends of the gold to silver ratio. This shows how important it is still today.

Trading Strategies for the Gold/Silver Ratio

For those in precious metals, the gold to silver ratio guides trading. Traders use it to find price mismatches between gold and silver. They watch for market or economic shifts. Let’s explore strategies tied to the gold to silver ratio:

- Arbitrage Opportunities: Traders buy silver when the ratio is high, meaning silver is cheaper than gold. They do the opposite when the ratio is low.

- Hedging: Investors might use silver to protect against gold price drops, and vice versa, based on the ratio.

- Portfolio Diversification: Holding both metals, adjusted by the ratio, can spread risk and enhance a portfolio.

Historical Trends of Gold to Silver Ratio

The historical trends of the gold to silver ratio tell us about market changes. The ratio has seen big swings due to many factors like discoveries, industrial use, and economic stress. High ratios often happen in financial crises, with gold seen as safer than silver. But when the economy is strong, silver demand from industries can raise its price, lowering the ratio.

- The ratio has generally been between 40:1 to 70:1 over the last century.

- Recent years have shown more fluctuations, with the ratio reaching extreme highs and lows.

- Studying these trends can help predict future shifts and guide investment choices.

If you’re experienced or new to precious metals, understanding the gold-silver connection is key. The ratio between them is vital for smart investing in commodities.

Price of Spot Gold Per Ounce

Knowing the spot gold price is essential for both investors and economists. It shows the price per ounce of gold for immediate delivery. Gold’s role as both a commodity and an investment tool keeps its price constantly changing. Tracking the current gold price helps investors make smart choices.

Many things affect the spot gold price. Factors like economic reports, market speculation, central bank policies, and global tensions matter. These can make the current gold price move as investors change their risk approach.

- Inflation rates

- Currency values

- Global economic indicators

- Mining production levels

Gold is a popular choice for those looking to diversify or strengthen their portfolios. It’s seen as protection against inflation and currency drops. Gold’s enduring value adds to its appeal.

The current gold price is always a key topic in financial circles. Its long history of stability and the modern market’s complexity make it an intriguing investment area. The price per ounce reflects the world’s economic state and investor sentiment.

- Checking real-time gold prices through reliable financial news sources

- Understanding the market conditions that lead to price fluctuations

- Consulting with financial experts before making any investment decisions

Those who follow the spot gold price enter a world full of chances and challenges. With careful study and understanding market signals, they can approach this field more wisely.

Diversifying Investment Portfolios with Gold

Smart investors aim to protect their wealth and achieve long-term stability. They do this by diversifying investment portfolios with assets like gold. Gold has always been valuable and performs well as a safety net against inflation. It’s a smart pick for those looking to spread out their investment risks. We’ll first look at the common ways to invest in gold investments, then explore newer methods.

Gold Bars, Coins, and Bullion as Investments

When it comes to physical gold, investors often choose gold bars, coins, and bullion. These real assets give a sense of safety that paper assets don’t. Gold bars are known for their purity and are great for large investments. Coins, such as the American Eagle or Canadian Maple Leaf, are both valuable and collectible. By investing in these, you directly link to the gold market’s price.

- Gold bars: They’re pure and usually bought in big amounts.

- Coins: They’re collected and also used as money.

- Bullion: A term for tradable gold assets near the market price.

Alternative Gold Investment Vehicles

Beyond physical gold, there are alternative gold investment vehicles. Options like gold mining stocks or gold-backed digital currencies offer an easier way into the gold market. These don’t need you to store anything physically and usually have smaller fees. Gold mining stocks let you invest in the success of gold miners. Meanwhile, gold-backed cryptocurrencies mix cutting-edge blockchain tech with gold’s lasting value.

- Gold mining stocks: They are parts of companies that find or mine gold.

- Gold-backed cryptocurrencies: These digital coins are tied to gold’s value.

Conclusion

We’ve taken a deep dive into the world of precious metals. We focused on gold’s price per ounce. We looked at the many factors that affect gold’s value. This includes its history and how market forces play a role.

It’s vital to understand economic factors like interest rates and inflation. These affect gold prices, along with the geopolitical situation. We also talked about how gold prices are set on a global scale. Entities like the LBMA and COMEX play key roles. We also explored how gold and silver prices are connected. This offers strategic insights for investors.

Investing in gold can be done in many ways. This includes buying physical gold or investing in mining stocks. Gold’s allure and stability make it a strong investment choice. Our summary highlights important information for investors. It helps them make smart decisions and build a strong financial future. Gold is key to achieving financial resilience.