one ounce gold price in usa

Understanding the price of one ounce of gold in the USA is crucial for anyone interested in investing in this precious metal. Gold has been a symbol of wealth and value for centuries, and its price can significantly influence investment decisions. In this article, we will explore live gold prices, understand current trends, and discuss how these factors impact potential investors.

Live gold prices refer to the real-time value of gold per ounce at any given moment. These prices fluctuate based on various factors, including global economic conditions, geopolitical events, and changes in supply and demand. For investors, keeping track of live gold prices can provide insights into the best times to buy or sell.

Factors Influencing Gold Prices

- Economic Indicators: Inflation, interest rates, and the strength of the U.S. dollar can all affect gold prices. Generally, when the dollar weakens or inflation rises, gold prices tend to increase as investors seek a stable store of value.

- Geopolitical Events: Crises such as wars, political instability, or significant policy changes can drive investors toward gold as a safe haven, thus affecting its price.

- Supply and Demand: Gold mining activities and consumer demand for gold jewelry and technology can also impact prices. A decrease in supply or an increase in demand can lead to higher prices.

Gold Investment in the USA

Investing in gold can be a sound strategy for diversifying your portfolio and protecting against inflation. Here’s how you can invest in gold in the USA:

Physical Gold

Investors can purchase physical gold in the form of coins, bars, or jewelry. Coins like the American Gold Eagle are popular among collectors and investors alike. However, storing physical gold requires secure storage and insurance, which can add to costs.

Gold ETFs and Mutual Funds

Exchange-traded funds (ETFs) and mutual funds offer another way to invest in gold without holding the physical asset. These funds track the price of gold and provide liquidity and ease of trading.

Gold Mining Stocks

Investing in gold mining companies is another option. These stocks can offer exposure to gold prices, although they also carry risks related to the company’s performance and operations.

Current Gold Price Trends

Gold prices have shown significant volatility over the years, often reflecting broader economic conditions. Understanding these trends can help investors make informed decisions.

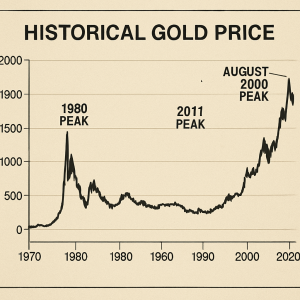

Historical Gold Price Trends

Over the last few decades, gold prices have experienced several peaks and troughs. For instance, during the 2008 financial crisis, gold prices soared as investors sought a safe haven. Similarly, the COVID-19 pandemic saw gold prices reach new highs due to economic uncertainty.

Current Market Conditions

As of today, the price of one ounce of 24k gold in the USA remains a subject of interest for many investors. Fluctuations are common, and staying updated with live gold prices is essential for making timely investment decisions.

Calculating the Value of One Ounce of Gold

The value of one ounce of gold is influenced by its purity and the current market price. In the USA, gold is typically measured in troy ounces, which are slightly heavier than standard ounces.

Purity Levels

Gold’s purity is measured in karats, with 24k representing pure gold. The higher the karat, the more valuable the gold. When considering an investment, it’s crucial to understand the purity level and how it affects the price.

Spot Price

The spot price is the current market price at which gold can be bought or sold for immediate delivery. This price serves as a benchmark for transactions and can vary slightly between different markets.

Monitoring Gold Prices in the USA

by Jingming Pan (https://unsplash.com/@pokmer)

Staying informed about gold prices in the USA is vital for any investor. Here are some strategies to keep track of price changes:

- Financial News Platforms: Websites like Bloomberg and CNBC provide real-time gold price updates and analysis.

- Mobile Apps: Several apps offer live gold price tracking, enabling investors to monitor changes on the go.

- Investment Newsletters: Subscribing to newsletters from reputable financial analysts can provide insights into gold market trends and forecasts.

Conclusion

Investing in gold can be a valuable addition to your investment strategy, offering a hedge against inflation and economic uncertainty. By understanding the factors influencing gold prices and keeping track of current trends, you can make informed decisions about when to buy or sell. Whether you choose to invest in physical gold, ETFs, or mining stocks, staying informed about the one ounce gold price in the USA is crucial to maximizing your investment potential.