Gold prices in the future

Gold prices have always intrigued investors and economists alike. Their movements can signal shifts in the global economy. Understanding these trends is crucial for making informed investment decisions.

In recent years, gold has shown remarkable resilience. It has weathered economic storms and geopolitical tensions. This makes it a reliable asset for many.

Forecasting future gold prices involves analyzing various factors. These include economic indicators, geopolitical events, and market trends. Each plays a significant role in shaping the gold market outlook.

This article delves into gold price forecasts for the coming years. We will explore expert insights, regional trends, and investment strategies. Join us as we uncover what the future holds for gold prices.

Understanding Historical Gold Price Movements

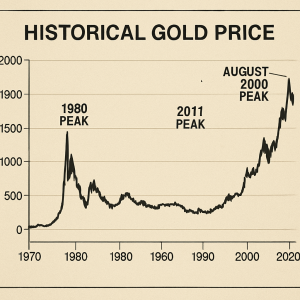

Gold has a long history of price fluctuations. These changes are influenced by numerous economic and social factors. Examining past trends helps predict future patterns.

Historically, gold prices have reacted to several key triggers:

- Inflation and deflation

- Changes in interest rates

- Economic recessions and recoveries

- Geopolitical events and unrest

The 2008 financial crisis, for instance, saw gold prices soar. Investors sought safety from volatile stock markets. More recently, gold’s value peaked during the COVID-19 pandemic, reflecting economic uncertainty. Understanding these movements can improve investment strategies.

By analyzing historical patterns, we can better anticipate how current events might impact future prices. These insights are valuable for anyone looking to invest in gold.

Key Factors Affecting Gold Price Forecasts

Several critical factors influence gold price forecasts. Understanding these elements helps investors make informed decisions. Economic indicators hold significant sway over gold prices.

The following factors are pivotal:

- Inflation: Higher inflation often leads to higher gold prices.

- Interest Rates: Rising rates typically reduce gold’s appeal.

- Currency Strength: A strong dollar can lower gold prices.

Geopolitical events also play a crucial role. Conflicts or tensions can drive investors towards gold as a safe haven. Moreover, central banks’ monetary policies can significantly impact gold values. Policies favoring financial stability tend to stabilize gold prices.

In the short term, investor sentiment and speculative activities can drive fluctuations. Yet, in the long term, broader economic trends and supply-demand dynamics are more influential. Understanding these factors helps project more accurate gold price predictions.

Gold Price Trends and Analysis: Recent Insights

Recent trends in gold prices offer valuable insights into the market. Over the past decade, gold has shown resilience during economic challenges. This has reinforced its reputation as a reliable asset for investors.

Key insights from recent analyses include:

- Gold’s role as a hedge against uncertainty has strengthened.

- Technological advancements affect gold mining costs.

- Demand from emerging markets is steadily rising.

Innovations in trading platforms have also influenced gold transactions. These platforms allow easier access to gold investments, attracting a broader investor base. Additionally, the digitalization of currencies has intrigued many investors, prompting comparisons with traditional assets like gold.

Analysts observe that while short-term gold price movements show volatility, the long-term outlook remains positive. Global economic recovery efforts post-pandemic may also play a crucial role in determining future gold prices.

Expert Gold Price Projections for 2025, 2026, and 2050

Experts predict significant trends in gold prices as we look toward 2025, 2026, and beyond. These projections, however, consider various macroeconomic factors that may influence prices. For investors, understanding these forecasts provides an essential basis for strategic planning.

Prominent experts highlight key aspects, such as:

- Geopolitical tensions affecting gold demand

- Economic recovery influencing gold valuation

- Central bank policies shaping gold reserves

Rhona O’Connell, a notable figure in gold price analysis, offers a nuanced perspective. Her forecast emphasizes the interplay between inflation and currency stability. Such insights are crucial for long-term investment strategies.

Other financial institutions provide diverse forecasts based on different factors. While some see a steady rise in prices, others anticipate fluctuations influenced by technological developments and environmental regulations. These variations highlight the importance of a diversified approach to investing in gold.

Thinking further ahead to 2050 requires considering even broader trends. Technological innovation, shifts in global power dynamics, and environmental considerations could all reshape the landscape. The future, while uncertain, still holds promising potential for gold as a stable asset.

Regional Focus: Gold Price Forecast Vietnam and Emerging Markets

Vietnam presents unique opportunities when considering gold prices in emerging markets. The country’s gold demand is influenced by cultural factors and economic growth, impacting its market dynamics. Emerging markets like Vietnam often experience shifts driven by local and global events.

Gold trends in Vietnam demonstrate:

- High consumer demand during cultural festivals

- Influence of regional trade policies

- Fluctuations tied to currency stability

Beyond Vietnam, other emerging economies also show distinct gold market traits. These regions often deal with varying levels of inflation and currency risk. As they continue to grow, these factors will likely play a significant role in shaping gold demand. In turn, understanding these dynamics helps investors anticipate potential shifts in global gold prices.

Short-Term vs. Long-Term Gold Price Forecasts

Gold price predictions vary significantly between short-term and long-term outlooks. Short-term forecasts often react to immediate events like geopolitical tensions or economic data releases. Market sentiment plays a crucial role in these brief adjustments.

Long-term forecasts, however, consider broader economic indicators. These include inflation trends, interest rate changes, and technological impacts on mining. With these insights, long-term projections often see fewer sudden changes.

Investors often consider both perspectives for balanced insights:

- Short-term: quick market reactions, influenced by current events

- Long-term: broader economic trends, more stable outlook

- Strategy: balancing both for informed decisions

Understanding these distinctions helps in strategic gold investment planning, aligning with financial goals and risk tolerance.

Gold Investment Forecast: Strategies and Market Outlook

Investing in gold involves analyzing various strategies and outlooks. As a safe-haven asset, gold often shines during economic uncertainty. Its performance correlates inversely with equities, providing a hedge against market volatility.

Several factors influence gold investment strategies. Investors must consider inflation rates and currency fluctuations. Central bank policies also significantly affect gold demand and pricing. Incorporating these insights leads to more robust investment decisions.

To maximize returns, consider these strategies:

- Diversification: Balancing gold with other assets in a portfolio

- Timing: Entering the market during dips for better gains

- Trends: Following major economic indicators

The gold market outlook suggests steady demand and potential growth. Understanding these dynamics enhances investment strategies, ensuring resilience in varied economic climates.

Conclusion: What the Future Holds for Gold Prices

The future of gold prices involves several dynamic factors. Economic stability, geopolitical tensions, and market volatility will continue to play pivotal roles. Understanding these elements helps in anticipating market trends and price movements.

As a reliable investment, gold offers significant potential for growth and security. Expert forecasts and analyses provide valuable guidance for investors navigating this complex market. While uncertainties persist, gold’s role as a hedge against inflation and economic downturns remains steadfast. Looking ahead, staying informed and adaptable will be key for those leveraging gold in their investment strategies.