Are you checking the gold price per kilogram? It’s key for making wise choices in the gold market. Prices change due to many factors. Knowing the gold’s current value can lead to good chances of profit.

Knowing the gold per kilogram price helps you make good moves in the market. This is true if prices go up or down. It’s important for both experienced and new investors to have the latest info.

So, where can you get reliable gold price updates? You’re in luck! In this article, we’ll cover the best places for current prices and more. You’ll get real-time updates, past data, and learn what affects gold prices.

We’ll share gold price per kilogram charts and trend analysis. This info will help make your gold investment adventure better. Stay with us for tips that set you up for success.

Let’s explore the interesting topic of gold prices. See how it can affect your investment choices!

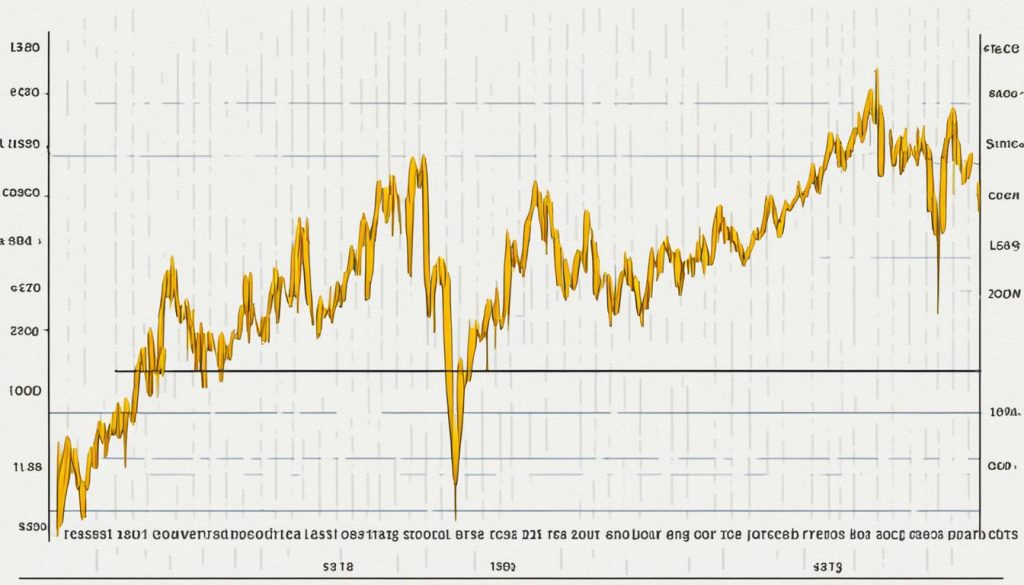

Gold Price per Kilogram Charts

Investors need real-time gold price info. They use gold price per kilogram charts to stay updated. These charts help investors see market trends.

On platforms like TradingView and BullionVault, you can find these charts. They cover many currencies. This makes it easy to watch gold prices and find good buying or selling chances.

These charts show not just today’s prices, but also past data. The past data lets investors see long-term gold trends. By looking at past prices, investors learn about gold’s behavior as an investment over time.

Gold price per kilogram charts are helpful for all investors. They offer the latest market info. So, investors can make smart moves when they know what’s happening.

Why should I use gold price per kilogram charts?

- Accurate and up-to-date information: They give real-time price updates. So, you always have the most accurate info when making decisions.

- Multiple currency options: These charts show prices in different currencies. This lets you track gold in your own currency, making it more personal.

- Historical data analysis: Studying old price data helps you see patterns and trends. This is key for a smart investment strategy.

- Timing your investment decisions: With updated info and past data, you can make smart investing choices. These charts help you invest at the right time.

Use gold price per kilogram charts to improve your investment game. With the right info and analysis, you can confidently trade gold.

Factors Affecting Gold Prices

Gold prices can change because of different things like supply and demand. Investors need to know these to make smart choices. This is important for buying gold.

Supply and Demand Dynamics

How much gold is available and how much people want it affects its price. If many want gold but there’s not enough, the price goes up. If there’s a lot of gold but not many people want it, the price might go down. Things like mining, the economy, and how much people want gold for jewelry or technology change this.

Central Bank Monetary Policies

Central banks’ money rules can also change gold prices. They have a lot of gold. When they buy or sell, it changes how much gold is out there. If they worry about inflation and print more money, people might buy gold to keep safe. This can make gold cost more.

Inflation Rates

When prices go up because of inflation, the money you have can buy less. People often buy gold then. They think gold is a good way to keep their money’s value safe. This makes the demand for gold go up, and so does its price.

Performance of Stock Markets and Bonds

How the stock market and bonds are doing can affect gold too. If they’re not doing well, people might prefer gold. They see gold as a safe choice. This can make the demand for gold go up and its price. If stocks and bonds do really well though, people might not buy gold, which could make the price drop.

Understanding gold prices means thinking about many things. Before you invest in gold, think about what might make its price change. This can help you make the right choice.

Knowing what makes gold prices change helps investors. By keeping up with the news about gold, you can make better decisions. This way, you can earn more from your gold investments.

Benefits of Investing in Gold

Gold is a great option for investing. It has benefits that can make your investments better. It also helps keep your wealth safe, even during tough times.

Gold has always been a safe choice. When things get tough in the economy, people trust gold. Its worth has been solid for many years.

Gold is also good at fighting inflation and money changes. When the value of money goes down, gold’s stays the same or goes up. It helps keep your money strong.

Gold’s value often goes up when other investments drop. Keeping some gold can help lower the risk in your investments. It makes your portfolio more varied.

Investing in gold has many benefits:

- It has been a stable safe place for a long time

- It protects against inflation and money changes

- It adds diversity to your investments, making them safer

Adding gold to your investing plans can make your money safer. It can help improve your financial safety.

Buying and Selling Gold

Buying and selling gold can happen in many ways. For example, BullionVault is a top choice online. It’s trusted by many investors all over the world.

At BullionVault, you can buy and sell gold using different currencies. You can use US Dollars, Euros, British Pounds, and Japanese Yen. This lets you make the most of market chances in different places.

Using BullionVault means you can access gold at wholesale prices. This helps you get the best deal, whether you’re new to investing or experienced. It’s easy to use, too.

Security is always top-notch with gold dealings. BullionVault keeps your gold in safe vaults. This ensures your investment is always protected.

Investing in gold can help have a more varied investment group. Also, it can protect you when the market goes up and down. With BullionVault, you can trade easily and with confidence.

Are you thinking of buying gold for the future, or selling to make a profit? BullionVault is the go-to place for trading. It’s safe, reliable, and simple to use.

Gold Price Fluctuations

The price of gold moves a lot and can change quickly, even within seconds.

Changes happen because of gold’s supply and demand. Also, what happens in other markets like stocks and bonds can affect gold’s price.

Investors use real-time updates and gold price charts. These tools help them see gold’s value change all the time.

With these updates, investors can watch the market closely. This lets them make smart choices about when to buy or sell.

Watching these price changes can show investors trends. They can then make good moves at the right times.

Looking at charts with past prices can also help. This historical view guides expectations on what gold might do next.

Combining current updates with past data helps investors a lot. It gives them confidence to make better choices in the gold market.

It’s key for investors to understand and follow gold price changes. They need these skills to make the most of their investments.

Thanks to real-time updates and history, they can. This way, they are ready to act wisely in the ever-shift gold market.

Historical Gold Price Trends

Looking at past gold prices helps people understand its value over time. Investors can learn from these old prices. They can see what might happen in the future.

Gold prices have gone up and down a lot over time. This happens because of many reasons, like the economy and politics. By knowing these trends, investors learn how gold reacts to different situations.

By looking at old gold prices, investors can see some patterns. This can help them guess what might happen with gold prices next. Seeing how gold has done in hard times before, like in crises, can be useful.

The Gold Standard

The gold standard was a big deal for gold prices. It tied the value of money to gold’s amount. This made gold prices stay pretty steady before the early 1900s.

But after the gold standard ended, things changed. Now, gold prices go up and down a lot. This happens because of things like war, crises, and government choices.

Long-Term Safe Haven

Gold is seen as a safe choice when the economy is shaky. People buy more gold in tough times. This can raise the price of gold. It makes gold a good choice for some investors.

During the 2008 crisis, gold prices went up. People looked to gold for safety. It’s a good sign that gold can be a safe place during financial problems. Knowing gold’s history helps investors take advantage of this.

Seasonal Patterns

Gold prices can change during certain times of the year. This is often because of celebrations or economic trends. For example, many gold-buying cultures boost demand during festivals.

In India’s Diwali or China’s New Year, gold prices might go up. Investors can use these trends to their advantage. They can buy or sell gold at the right time.

Gold as a Financial Insurance

Gold is like a financial insurance when times are tough. It holds its value well and is safe. This makes it a top choice for people wanting security in their investments.

It stays strong even when the economy is not doing well. Gold is trusted for its ability to keep its value. Its value doesn’t drop easily, offering a shield in hard times.

Over time, gold has shown it’s good at fighting inflation. Other money types lose their value to inflation, but gold doesn’t. It’s a smart way to keep money safe from inflation.

People buy gold when they think the economy will be bad. Gold usually does well when other investments are struggling. It balances out risks in an investment mix, making it very valuable.

Gold brings peace and safety in uncertain times. Its strong history and safe nature woo investors. It’s great for those wanting to keep their investment safe and steady.

Gold Price Forecast and Outlook

Predicting gold prices is hard because many things affect them. But looking at the past and keeping up with the news can help investors.

Looking into gold’s price history shows how it behaves. This can help spot signs and make smarter choices. Remember, the past might not show the future, but it guides.

Knowing the latest news on gold is key. Events and policies change gold’s demand and supply. Being up-to-date lets investors plan better.

Keep in mind, predictions aren’t always right. The gold market is full of surprises. But, keeping an eye on trends and listening to experts can help understand prices better.

Financial markets are risky, but watching gold forecasts can reduce those risks. It’s important for both long-term investors and those looking for quick gains to understand the market well.

Benefits of Staying Informed

- Minimize investment risks: Keeping track of forecasts helps lower risk.

- Maximize investment opportunities: Knowing the trends aids in finding good chances.

- Informed decision-making: Being updated helps in smart choices about gold.

- Strategic portfolio management: With the right info, managing investments including gold gets easier.

The gold market is complex, making it tough to predict future moves. But, with knowledge, historical data, and current news, investors can improve their decision-making.

Conclusion

Gold price updates are key for those investing. By watching the charts, you can spot good times to buy or sell. Knowing gold’s past helps you see how well it does over the years.

Many things influence gold prices. These include how much is available, what people want, central bank rules, inflation, and the economy. It’s smart to keep up with news to get ahead in investing.

Gold has its perks. It keeps your money safe when times are tough. It also beats inflation and adds variety to your investments. With good research, you can do well in the gold market.