Stay updated with the latest gold and silver spot price today. Get live market data to make informed investment decisions. At any given moment, gold and silver prices can fluctuate, influenced by various factors such as investor sentiment, supply and demand fundamentals, and global economic conditions.

Knowing the current spot price of gold and silver is crucial for investors who are looking to buy or sell precious metals. With real-time information on bid and ask prices, you can stay ahead of the market and capitalize on potential opportunities.

Whether you are a seasoned investor or new to the world of precious metals, monitoring live updates on gold and silver spot prices can provide valuable insights into market trends and price movements. By keeping a close eye on the live market data, you can make informed decisions and maximize the potential returns on your investments.

Throughout this article, we will explore various aspects of gold and silver prices, including the factors that affect them, historical analysis, the correlation between gold and silver, and the role of governments and banks in price manipulation. We will also delve into the relationship between gold, silver, platinum, and palladium, as well as the role of futures markets and spot prices in determining the current value of precious metals.

But first, let’s take a look at the live updates for the gold and silver spot price today:

Stay tuned for the latest updates on the gold and silver spot prices throughout this article. Empower yourself with real-time market data and make informed investment decisions.

Understanding Precious Metal Chart Timeframes

When analyzing precious metal price charts, it is important to consider the timeframe. Different timeframes provide valuable insights into the market dynamics and can help investors make informed decisions. Here are some common chart timeframes to consider:

Short-Term Timeframes:

- 24 hours: This chart provides a snapshot of price movements within a single day.

- 7 days: A week-long chart allows investors to track short-term trends and price fluctuations.

- 1 month: This timeframe provides a broader view of recent market performance.

- 3 months: Investors can examine quarterly trends and identify potential patterns.

- 6 months: This chart showcases the price movements over half a year, giving a more comprehensive outlook on recent performance.

Long-Term Timeframes:

- 1 year: This timeframe helps investors assess annual trends and market cycles.

- 5 years: A 5-year chart provides a longer-term perspective on price movements.

- 10 years: The 10-year chart offers a significant historical view to help investors understand long-term trends.

Short-term fluctuations captured in shorter timeframe charts can be beneficial for short-term investors who aim to capitalize on rapid price movements. However, it is important to consult both short-term and long-term charts for a comprehensive understanding of the market trends. Short-term fluctuations may not always reflect the overall market trajectory.

Dollar-cost averaging, on the other hand, is a recommended long-term investing strategy. It involves making consistent investments in precious metals over time, regardless of short-term price fluctuations. By spreading the investment over regular intervals, dollar-cost averaging reduces the impact of market volatility and allows investors to accumulate assets at different price points. This approach helps mitigate the risk of investing a large sum at a potentially unfavorable price and can lead to favorable long-term returns.

By analyzing precious metal chart timeframes and combining them with other fundamental and technical analysis tools, investors can make more informed decisions and navigate the dynamic precious metals market with confidence.

Live Metals Prices and Market Data

Stay up-to-date with real-time information on bid and ask prices for gold, silver, platinum, and palladium. These live metals prices fluctuate throughout the day, influencing investment decisions and providing valuable insights for traders and investors.

Knowing the current bid/ask prices is essential for understanding market trends and making informed buying or selling choices. Whether you’re interested in gold, silver, platinum, or palladium, monitoring live prices allows you to act quickly and seize opportunities as they arise.

With live metals prices, you can track minute-by-minute changes and respond accordingly, adjusting your investment strategy based on market fluctuations. Whether you’re a seasoned investor or a beginner exploring the world of precious metals, having access to real-time market data is crucial.

Benefits of Live Metals Prices:

- Stay informed about the latest bid/ask prices for gold, silver, platinum, and palladium.

- React quickly to price movements and take advantage of buying or selling opportunities.

- Monitor market trends and make informed investment decisions.

- Better understand the relationship between live metals prices and economic factors.

- Plan your trades or investments based on up-to-the-minute market data.

Whether you’re interested in the historical performance of gold and silver, seeking to diversify your portfolio with platinum and palladium, or simply want to stay informed about the precious metals market, live metals prices provide you with access to real-time data that can help you make informed decisions.

Factors Affecting Gold and Silver Prices

Gold and silver prices are influenced by various factors that contribute to price fluctuations in the market. Understanding these factors is essential for investors to make informed decisions. The three main factors that affect gold and silver prices are:

1. Investor Sentiment

Investor sentiment plays a significant role in shaping the demand for gold and silver. During times of economic uncertainty, political instability, or market volatility, investors often turn to precious metals as a safe-haven investment. This increased demand can drive up prices. On the other hand, when investors are optimistic about economic growth and stability, they may shift their investments away from precious metals, leading to lower prices.

2. Supply and Demand Fundamentals

The supply and demand dynamics of gold and silver also heavily influence their prices. Changes in mining production, recycling rates, and central bank policies can impact the supply side of the equation. Meanwhile, factors such as industrial demand, jewelry consumption, and investment demand contribute to the overall demand for these metals. When demand outstrips supply, prices tend to rise, while an oversupply can lead to price declines.

3. Price Fluctuations

Gold and silver prices are known for their volatility, experiencing fluctuations on a daily basis. These price movements can be influenced by a range of factors, including geopolitical events, economic indicators, central bank policies, and currency movements. Traders and speculative investors closely monitor these price fluctuations to identify trading opportunities.

In summary, the price of gold and silver is influenced by investor sentiment, supply and demand fundamentals, and price fluctuations. Understanding these factors can help investors navigate the dynamic precious metals market and make informed investment decisions.

The Role of Governments and Banks in Price Manipulation

Governments, central banks, and investment banks play a significant role in the manipulation of gold and silver prices. This is often done to maintain stability in the financial world and protect the interests of these institutions. One of the methods through which price manipulation occurs is in the paper market.

In the paper market, financial institutions such as bullion banks trade derivative contracts and futures on precious metals, including gold and silver. These contracts are bought and sold without the physical delivery of the metals. The high trading volume in the paper market can exert considerable influence on the spot prices of precious metals.

Price suppression of gold and silver can occur when bullion banks engage in short selling in the futures market. By selling a substantial amount of contracts, these banks create a downward pressure on prices, leading to a decrease in the spot price.

Moreover, governments and central banks may also intervene in the gold and silver markets to control their prices. For instance, central banks may sell their gold reserves or make strategic announcements that impact market sentiment.

The price suppression activities of governments and banks can have wide-ranging consequences. These actions can impact the correlation between spot prices and real-world pricing for gold and silver, making it important for investors to understand the dynamics of the paper market and its influence on the overall market.

Summary:

- Governments, central banks, and investment banks engage in price manipulation to maintain financial stability.

- The paper market, where derivative contracts and futures are traded, plays a key role in this manipulation.

- Bullion banks often engage in short selling to suppress gold and silver prices.

- Government interventions and strategic announcements impact market sentiment.

Historical Analysis of Gold and Silver Prices

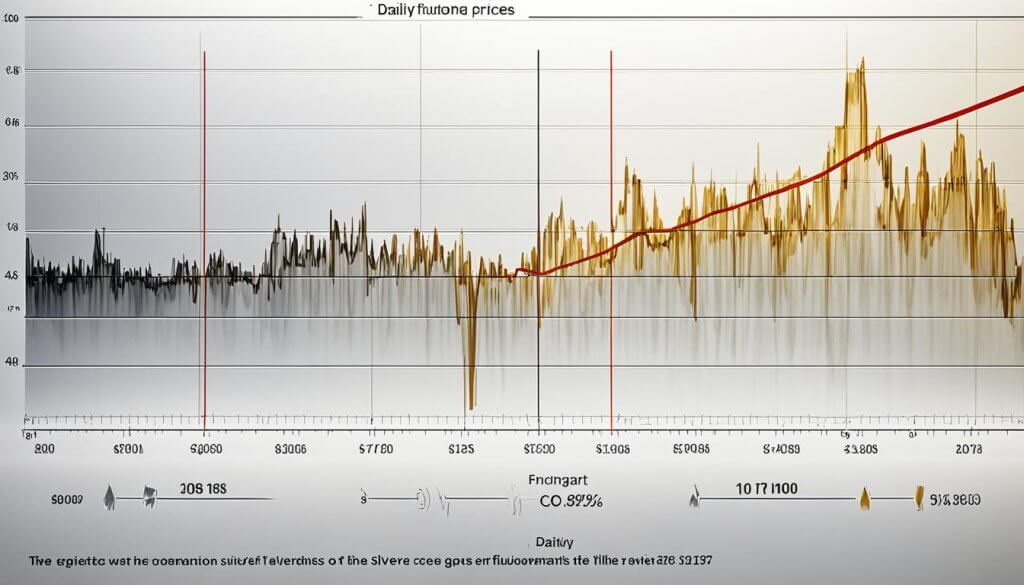

During the Great Depression, gold and silver experienced significant fluctuations in prices, reflecting the economic turmoil of the time. As investors sought safe-haven assets to preserve their wealth, the purchasing power of gold and silver surged.

Inflationary panics and the erosion of fiat currencies during the Great Depression further boosted the appeal of gold and silver as stores of value. Investors turned to these precious metals to hedge against the loss of purchasing power caused by rampant inflation.

Gold and silver prices can be influenced by various factors during periods of economic crises and inflationary panics. These include the overall demand for safe-haven assets, investor sentiment, and the perception of gold and silver as storehouses of value.

To illustrate the impact of the Great Depression on gold and silver prices, consider the following historical data:

- In 1931, during the height of the Great Depression, the price of gold increased by over 154%.

- Similarly, the price of silver more than doubled during the same period.

- These price increases were driven by the growing distrust in fiat currencies and the belief that precious metals could provide stability and security.

The image above visually represents the surge in gold and silver prices during the Great Depression, highlighting their role as valuable assets during times of economic uncertainty.

Understanding the historical price movements of gold and silver is essential for investors looking to make informed decisions about their portfolios. By analyzing past trends and considering the economic climate, investors can gain insights into potential future price movements and their impact on purchasing power.

Gold and Silver Prices in Recent Years

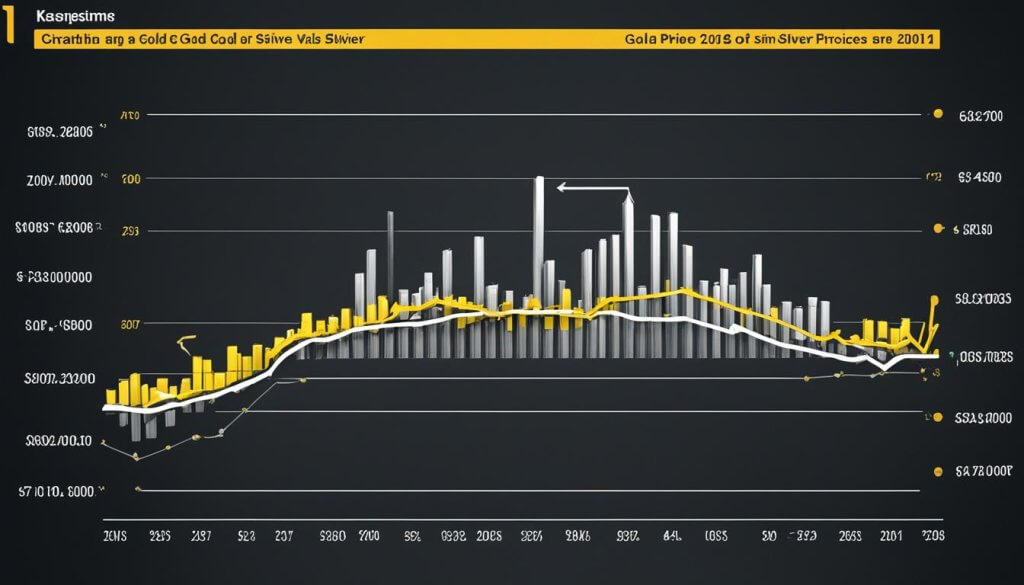

In 2011, the gold and silver markets experienced significant price movements, reaching all-time highs. These price increases were influenced by various factors, including the Federal Reserve’s Quantitative Easing programs and mounting inflation fears.

The Federal Reserve’s Quantitative Easing, also known as QE, refers to the central bank’s implementation of expansionary monetary policies to stimulate the economy during times of economic downturn. The program involved the purchase of large quantities of government securities, injecting liquidity into the financial system. This massive influx of liquidity created concerns about future inflation, prompting investors to seek alternative stores of value such as gold and silver.

Furthermore, mounting inflation fears contributed to the surge in gold and silver prices. As investors anticipated rising inflation rates, they turned to these precious metals as a hedge against the erosion of purchasing power. The perceived value of gold and silver as inflation-resistant assets drove demand and subsequently propelled prices to unprecedented levels.

Overall, the gold and silver price increases witnessed in 2011 were driven by a combination of Federal Reserve Quantitative Easing programs and inflation fears. These factors highlight the role of central banks and monetary policies in shaping precious metal markets and reflect the ongoing concerns of investors regarding economic stability and the preservation of wealth.

Image: Gold and silver prices experienced significant increases in 2011, driven by Federal Reserve Quantitative Easing programs and inflation fears.

The Correlation Between Gold and Silver

When examining the relationship between gold and silver, it is evident that they often move in the same direction. The prices of these precious metals tend to exhibit a positive correlation, meaning that when one metal experiences a price increase or decrease, the other metal typically follows suit. However, it is important to note that silver tends to be more volatile compared to gold. This volatility can result in larger price fluctuations and make silver a more attractive option for traders seeking short-term opportunities.

Despite their usual correlation, there are instances when silver may decouple from gold. These decouplings can occur during specific market conditions or shortage situations. For example, if there is a scarcity of gold due to limited supply, the price of gold may rise significantly while silver remains relatively stable or experiences only a marginal increase. Similarly, industrial demand plays a crucial role in determining silver prices. Silver’s applications in various industries, such as electronics and solar panels, can drive its value independent of gold’s influence.

In summary, while gold and silver generally maintain a positive correlation, silver’s volatility and industrial demand can cause deviations from this trend in certain circumstances.

The Relationship Between Gold, Silver, Platinum, and Palladium

Precious metals play a significant role in the global economy and are often regarded as safe-haven investments. While each metal has its unique characteristics and uses, there is a correlation between them that impacts their prices.

All precious metals share some positive correlation, especially during inflationary periods. When investors are concerned about rising inflation, they often turn to precious metals as a hedge against the devaluation of fiat currencies and as a store of value.

However, it’s important to note that platinum and palladium have a more pronounced sensitivity to economic cycles compared to gold and silver.

Platinum and Economic Cycles

Platinum is widely used in various industries, particularly in the automotive sector for catalytic converters. As a result, the demand for platinum is closely linked to economic conditions, especially automotive production and sales.

During periods of economic growth and prosperity, the demand for vehicles increases, leading to higher demand for platinum. Conversely, during economic downturns or recessions, the demand for vehicles decreases, putting downward pressure on platinum prices.

This sensitivity to economic cycles makes platinum a valuable metal to monitor when assessing the overall health of the global economy and automotive industry.

Palladium and Economic Cycles

Similar to platinum, palladium is also used in the automotive industry for catalytic converters. Palladium has become the primary choice for gasoline-powered vehicles, while platinum is more commonly used in diesel-powered vehicles.

As with platinum, the demand for palladium is heavily influenced by economic cycles and automotive production. When economic conditions are favorable, leading to increased vehicle sales, the demand for palladium rises. Conversely, during economic downturns, the demand for palladium declines, resulting in lower prices.

Given palladium’s prominent role in gasoline-powered vehicles, it’s closely tied to consumer sentiment and the overall health of the automotive industry.

In conclusion, while there is a correlation between gold, silver, platinum, and palladium, platinum and palladium are more sensitive to economic cycles, particularly automotive demand. Monitoring the trends and prices of these metals can provide valuable insights into the overall state of the global economy and specific industries.

The Role of Futures Markets and Spot Prices

Spot prices for gold, silver, platinum, and palladium are determined through futures exchanges, with COMEX being one of the prominent players in the market. These exchanges facilitate the trading of contracts that represent the future delivery of these precious metals.

The spot price is the current market price at which precious metals can be bought or sold for immediate settlement. It serves as a benchmark for investors, traders, and industry participants.

The relationship between spot prices and futures markets is crucial in understanding price discovery. Futures contracts, which represent agreements to buy or sell an asset at a future date, reflect the market’s sentiment and expectations regarding the future price of the underlying asset.

COMEX, part of the CME Group, is an influential exchange for gold, silver, platinum, and palladium futures trading. It provides a transparent marketplace for participants to engage in price speculation, risk management, and hedging strategies.

Spot prices fluctuate throughout the trading day, driven by various factors such as supply and demand dynamics, economic indicators, geopolitical events, and market sentiment. The nearest active delivery month typically determines the spot price.

To better understand the relationship between spot prices and futures contracts, it’s important to consider the concept of contango and backwardation. Contango refers to a situation where the future price of an asset exceeds the spot price, indicating expectations of higher prices in the future. Backwardation, on the other hand, occurs when the spot price exceeds the future price, suggesting a market expecting lower prices ahead.

This interplay between spot prices and futures markets provides valuable insights for investors and traders, enabling them to assimilate market sentiment and make informed decisions. By monitoring these prices, individuals can gauge the market’s perception of future demand, assess price trends, and identify potential investment opportunities.

The Significance of Spot Prices

Spot prices serve as a reference point for various market participants, including jewelers, manufacturers, investors, and central banks. These prices influence physical bullion transactions, as well as financial products linked to precious metals.

Moreover, spot prices contribute to the determination of benchmarks and indices used in the valuation and pricing of derivatives, exchange-traded funds (ETFs), and other investment vehicles.

Understanding the relationship between spot prices and futures markets is vital for anyone interested in the precious metals market. By staying informed about spot prices and monitoring futures exchanges like COMEX, investors can gain a deeper understanding of market dynamics and potential price movements.

Summary:

- Spot prices for gold, silver, platinum, and palladium are determined through futures exchanges like COMEX.

- Futures contracts reflect market sentiment and expectations regarding the future price of these precious metals.

- COMEX provides a transparent marketplace for futures trading and serves as a crucial hub for price discovery.

- Spot prices fluctuate throughout the trading day, influenced by various factors.

- Contango and backwardation represent different market expectations for future price movements.

- Spot prices are reference points for market participants and contribute to benchmarks and indices.

Conclusion

In conclusion, keeping track of the gold and silver spot price today is essential for investors looking to make informed decisions. By monitoring live updates and staying informed about market data and trends, investors can have a clear understanding of the current market conditions and adjust their investment strategies accordingly.

The gold and silver spot price today is influenced by various factors, including investor sentiment, supply and demand fundamentals, and economic crises. These factors can lead to price fluctuations and trends in the market. Therefore, staying up to date with the live updates and understanding the underlying factors can help investors navigate the volatile precious metals market.

Whether you are a short-term or long-term investor, being aware of the gold and silver spot price today is crucial. Short-term investors can benefit from analyzing short-term charts to take advantage of price fluctuations, while long-term investors can use dollar-cost averaging strategies and consult both short-term and long-term charts for a comprehensive overview of the market.

FAQ

What is the importance of considering the timeframe when analyzing precious metal price charts?

When analyzing precious metal price charts, considering the timeframe is important as it provides a comprehensive understanding of the market trends. Common chart timeframes include 24 hours, 7 days, 1 month, 3 months, 6 months, 1 year, 5 years, and 10 years.

Are short-term fluctuations in precious metal prices beneficial for short-term investors?

Yes, short-term fluctuations in precious metal prices can be beneficial for short-term investors. However, it is recommended to consult both short-term and long-term charts for a comprehensive understanding of the market trends when making investment decisions.

What is dollar-cost averaging?

Dollar-cost averaging is a recommended long-term investing strategy where investors make consistent investments over time, regardless of market conditions. This strategy avoids making large investments at unfavorable prices and helps average out the cost of investments over the long term.

How do bid and ask prices for gold, silver, platinum, and palladium impact investment decisions?

Bid and ask prices for precious metals fluctuate throughout the day and can impact investment decisions. These prices indicate the buying and selling prices at a given time, allowing investors to determine the current market value and make informed decisions.

What factors influence gold and silver prices?

Gold and silver prices are influenced by investor sentiment and underlying supply and demand fundamentals. Factors such as geopolitical events, economic indicators, and market speculation can cause price swings and trends in the precious metals market.

Can gold and silver prices be manipulated by governments and banks?

Yes, governments, central banks, and investment banks may attempt to suppress gold and silver prices to maintain stability in the financial world. This can be done through the manipulation of the paper market and can impact the correlation between spot prices and real-world pricing.

Have gold and silver prices been affected by historical economic crises?

Yes, during the Great Depression, gold and silver gained significant purchasing power compared to other assets. Gold and silver prices can be affected by economic crises and inflationary panics as investors seek safe-haven assets to protect their wealth.

When did gold and silver prices reach all-time highs, and what were the contributing factors?

In 2011, gold and silver prices reached all-time highs. Contributing factors to this price surge included Federal Reserve Quantitative Easing programs aimed at stimulating the economy and rising inflation fears among investors.

What is the correlation between gold and silver prices?

Gold and silver prices tend to trend in the same direction, with silver being more volatile. However, there are periods when silver may decouple from gold, especially during specific market conditions or shortage situations. Additionally, industrial demand for silver can also affect its prices.

How are gold, silver, platinum, and palladium correlated?

All precious metals share some positive correlation, especially during inflationary periods. Platinum and palladium are more sensitive to economic cycles, particularly automotive demand, as they are primarily used in catalytic converters for vehicles.

How are spot prices for precious metals established?

Spot prices for gold, silver, platinum, and palladium are established through futures exchanges such as COMEX. These spot prices fluctuate throughout the trading day, and the nearest active delivery month determines the spot price.

Why is it important to stay informed with live updates on the gold and silver spot price today?

Staying informed with live updates on the gold and silver spot price today allows investors to monitor market data and trends in real-time. This information helps investors make informed decisions when buying or selling precious metals.